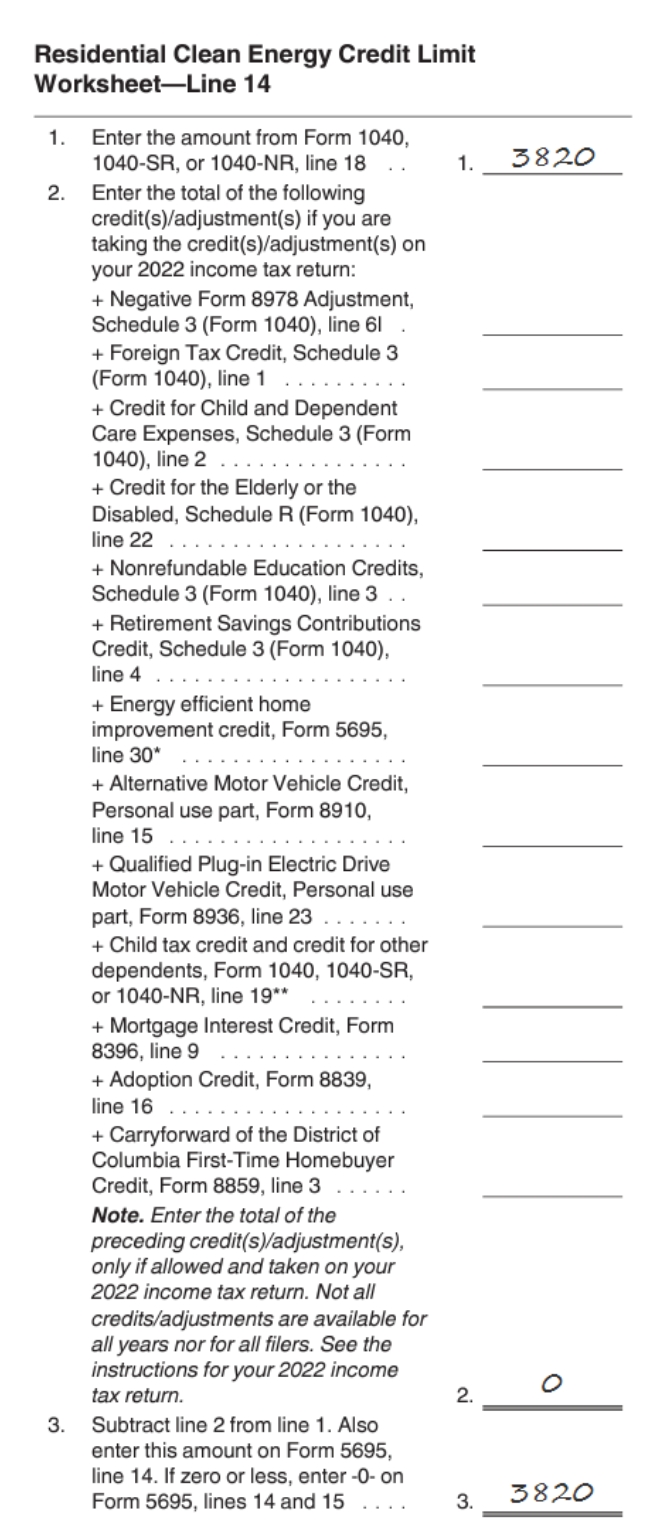

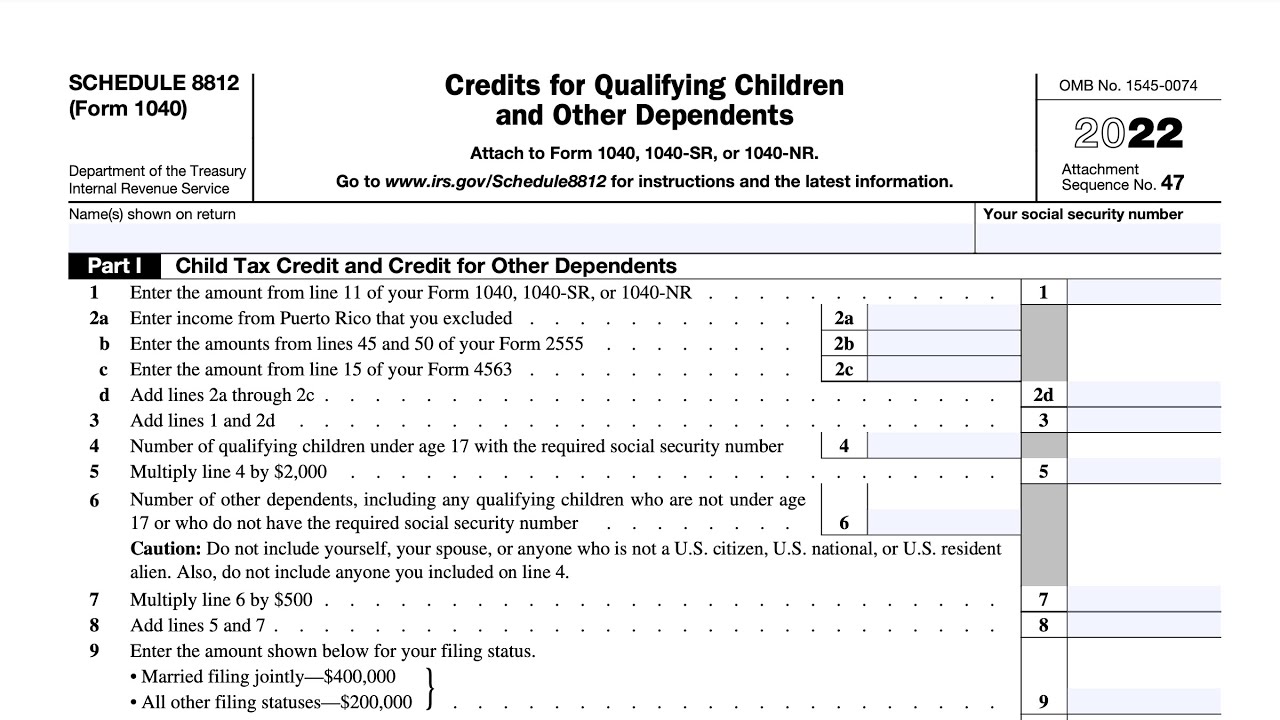

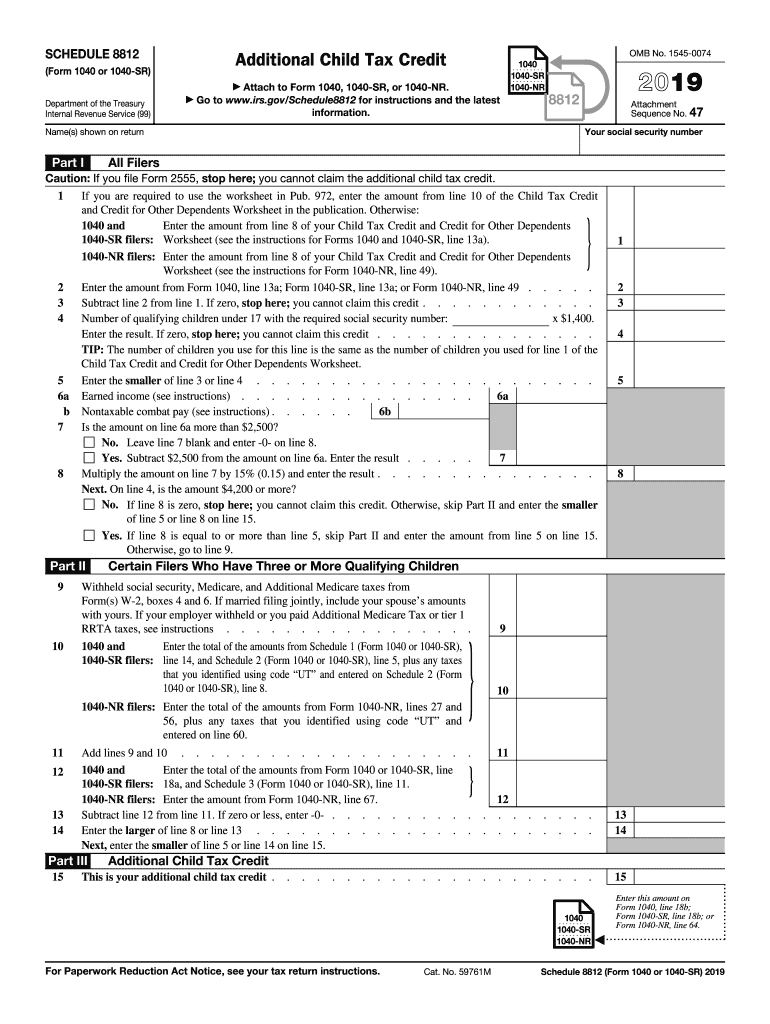

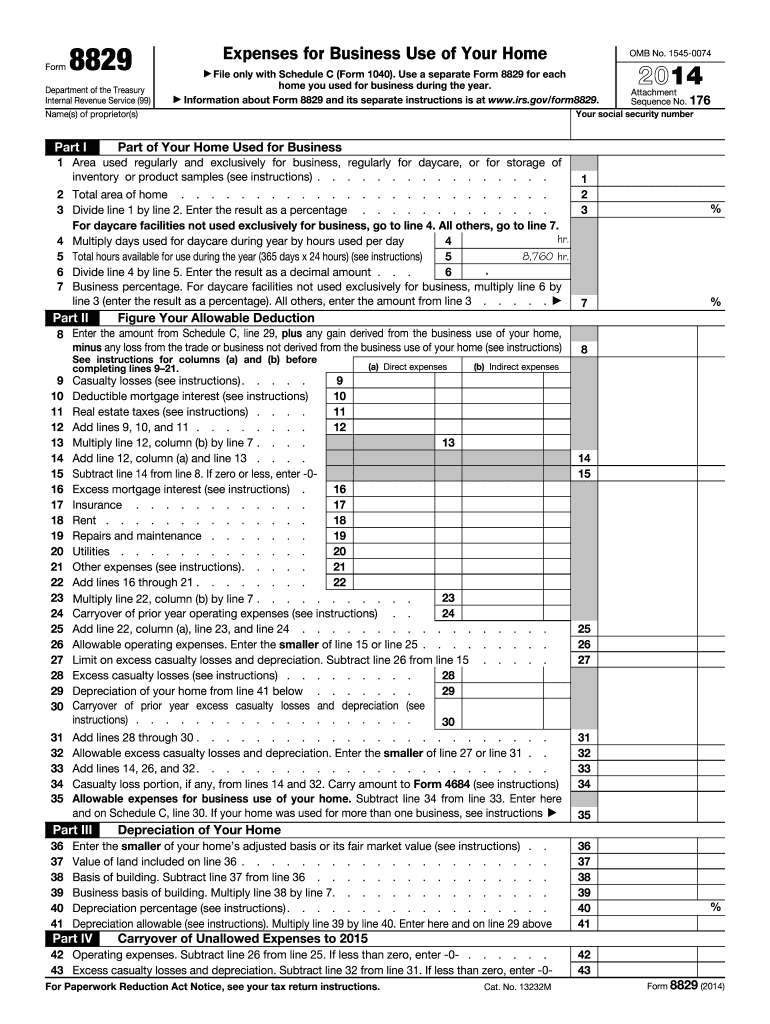

What Is The Credit Limit Worksheet A For Form 8812 - Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Finally found the credit limit worksheet a. It is located in the instructions. In credit limit worksheet a, start by entering the amount from line 18 of your form. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out.

It is located in the instructions. Finally found the credit limit worksheet a. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. In credit limit worksheet a, start by entering the amount from line 18 of your form.

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. It is located in the instructions. In credit limit worksheet a, start by entering the amount from line 18 of your form. 2022 schedule 8812 credit limit worksheet a keep for your records 1. Finally found the credit limit worksheet a.

What is the credit limit worksheet? Leia aqui What is line 5 worksheet

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Finally found the credit limit worksheet a. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. 2022 schedule 8812 credit limit worksheet a keep for your records 1. It is located in the instructions.

Form 8812 Credit Limit Worksheet A Printable Word Searches

2022 schedule 8812 credit limit worksheet a keep for your records 1. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. It is located in the instructions. In credit limit worksheet a, start.

Schedule 8812 Credit Limit Worksheet A

Finally found the credit limit worksheet a. It is located in the instructions. 2022 schedule 8812 credit limit worksheet a keep for your records 1. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill.

2023 Schedule 8812 Credit Limit Worksheet A

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. Finally found the credit limit worksheet a. In credit limit worksheet a, start by entering the amount from line 18 of your form. It is.

2022 Irs Form 8812 Credit Limit Worksheet A

It is located in the instructions. In credit limit worksheet a, start by entering the amount from line 18 of your form. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Finally found the credit limit worksheet a. Complete the credit limit worksheet b only if you meet all of the following..

2023 Schedule 8812 Credit Limit Worksheet A

Finally found the credit limit worksheet a. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out..

Credit Limit Worksheet A Schedule 8812

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. It is located in the instructions. Finally found the credit limit worksheet a. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out.

What Is The Credit Limit Worksheet A For Form 8812

In credit limit worksheet a, start by entering the amount from line 18 of your form. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. It is located in the instructions. 2022 schedule 8812 credit limit worksheet a keep for your records 1. If your employer withheld or you paid additional.

2022 Schedule 8812 Credit Limit Worksheet A

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one. Finally found the credit limit worksheet a. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet.

Irs Form 8812 Credit Limit Worksheet A

In credit limit worksheet a, start by entering the amount from line 18 of your form. It is located in the instructions. 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out. If your employer withheld or you paid additional.

The Schedule 8812 Credit Limit Worksheet A Is An Important Form That Taxpayers May Need To Fill Out.

2022 schedule 8812 credit limit worksheet a keep for your records 1. Finally found the credit limit worksheet a. In credit limit worksheet a, start by entering the amount from line 18 of your form. It is located in the instructions.

If Your Employer Withheld Or You Paid Additional Medicare Tax Or Tier 1 Rrta Taxes, Use This.

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one.