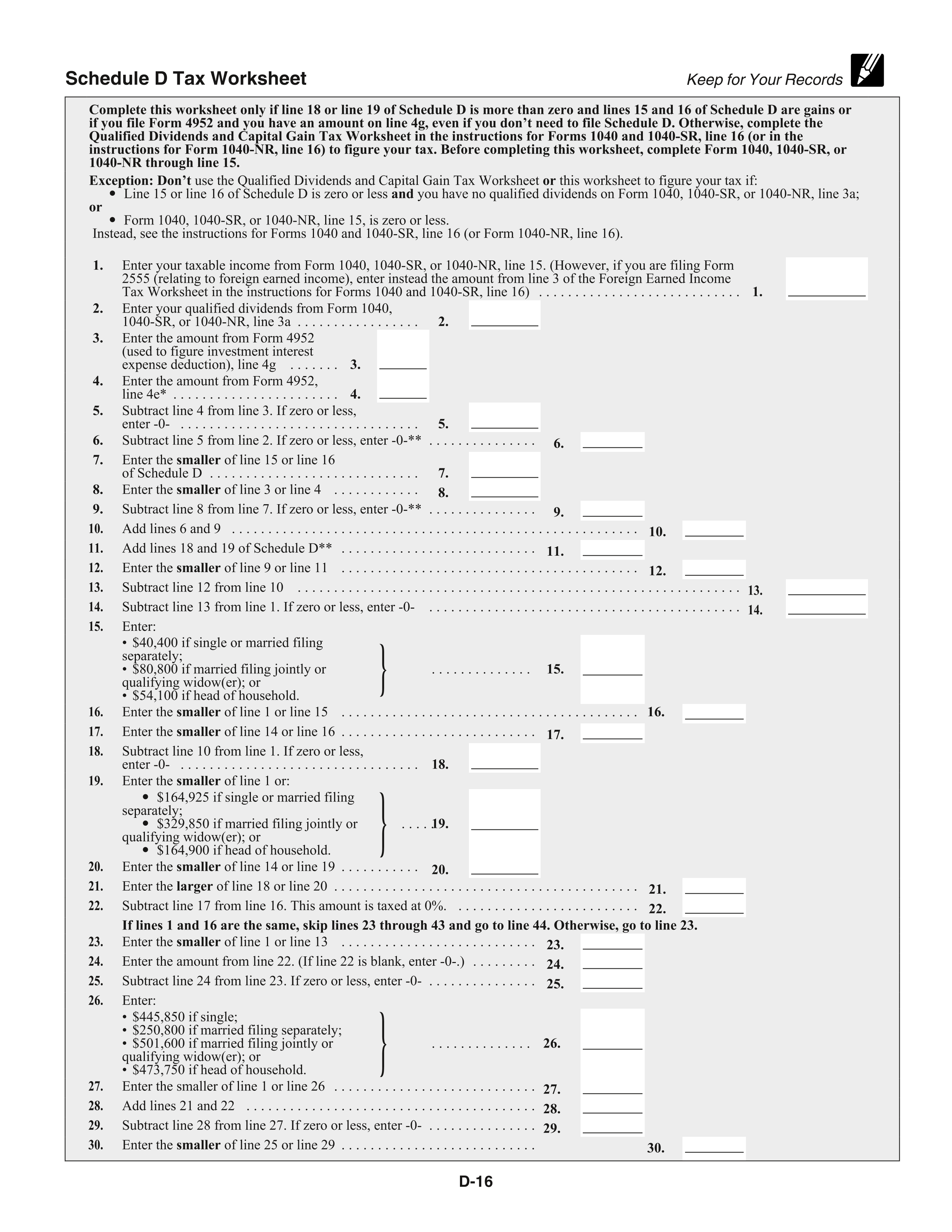

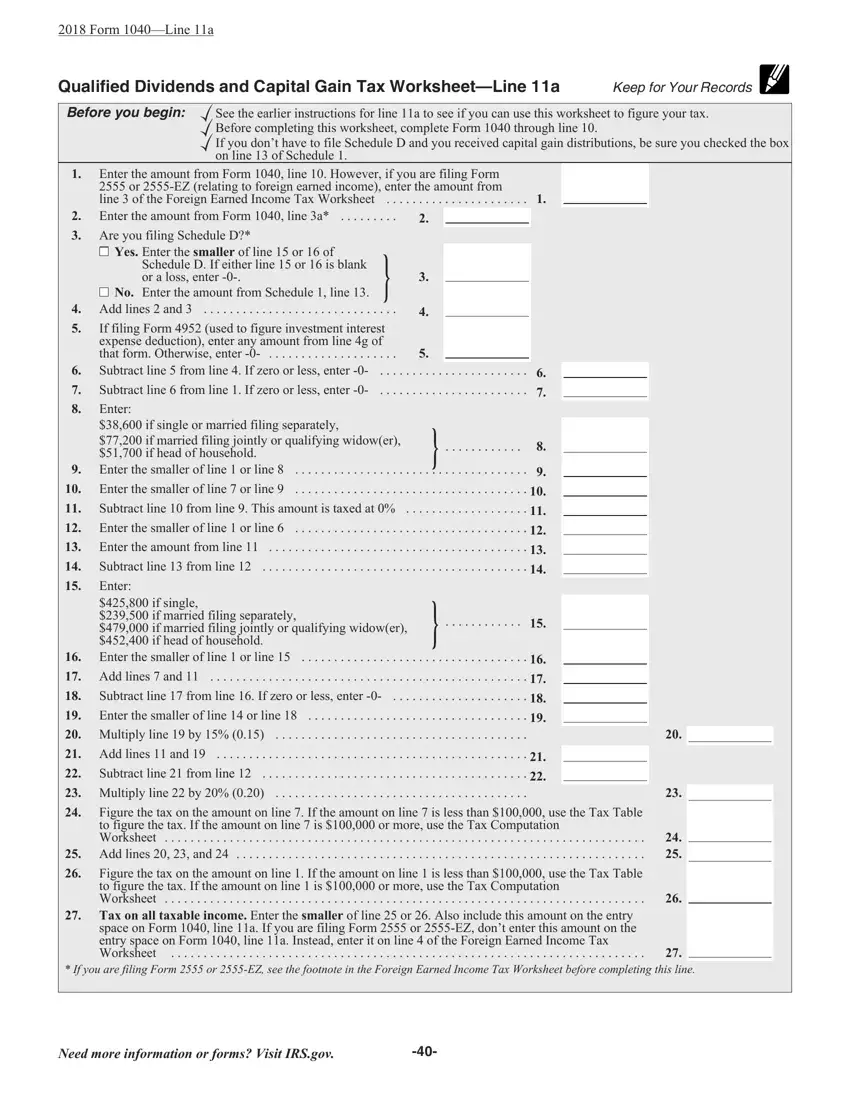

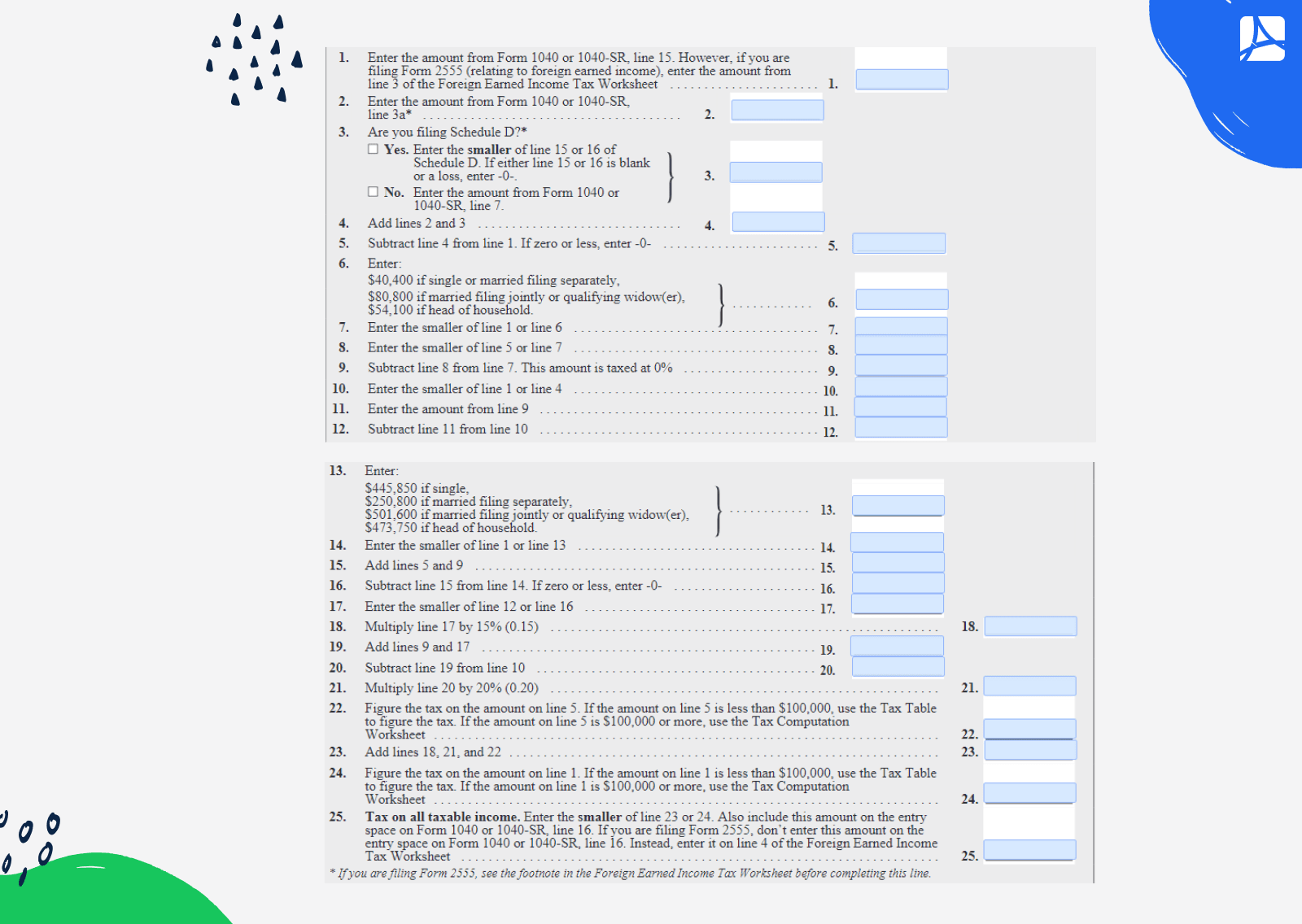

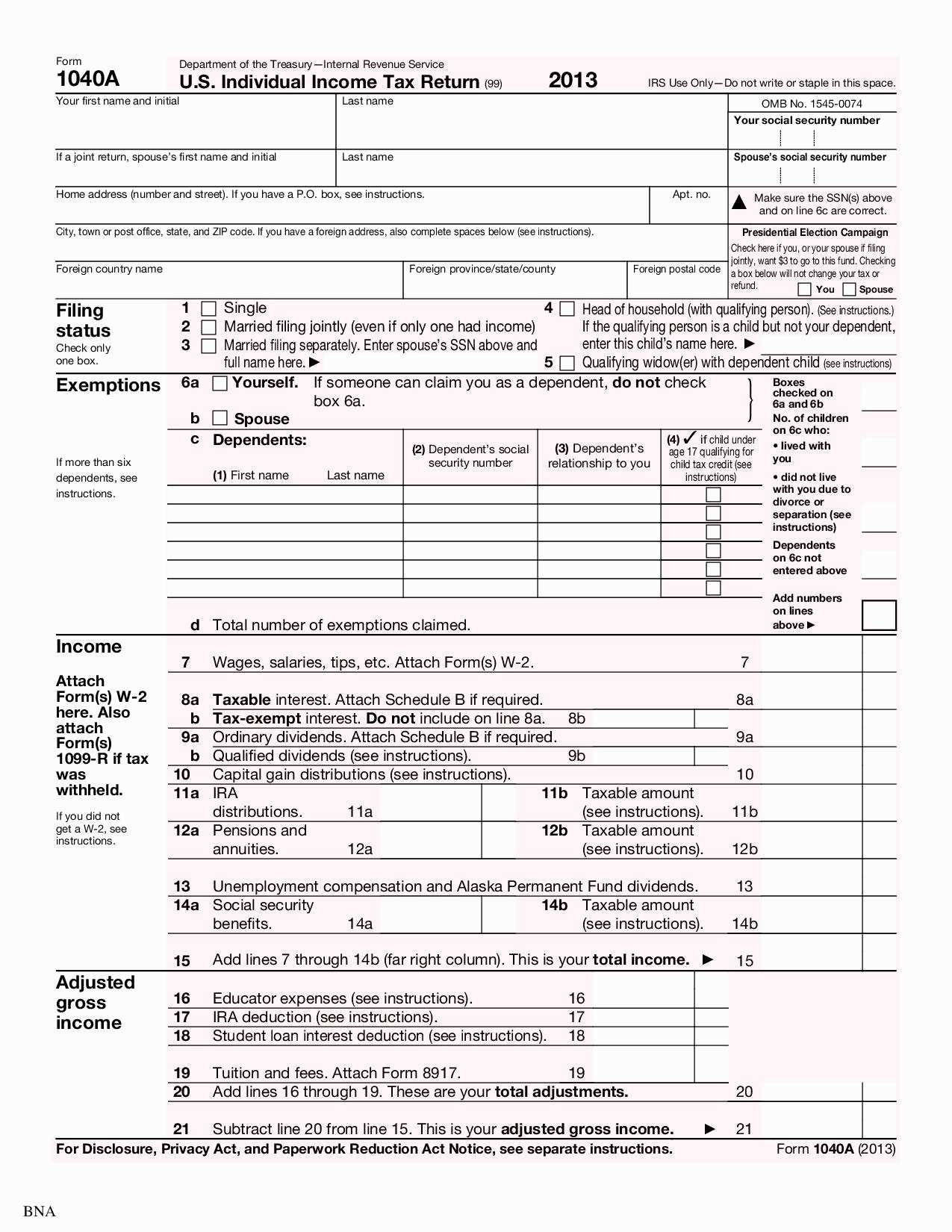

Qualified Dividends And Capital Gain Tax Worksheet Line 16 - Use 1 of the following methods to calculate the tax for line 16 of form 1040. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. V/ see the instructions for line 16 in the instructions to see if you can use this. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. This worksheet helps you calculate the tax on qualified dividends and capital gains that you.

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. V/ see the instructions for line 16 in the instructions to see if you can use this.

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Use 1 of the following methods to calculate the tax for line 16 of form 1040. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. V/ see the instructions for line 16 in the instructions to see if you can use this.

Qualified Dividends And Capital Gains Sheet

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. See the instructions for line 16 to see if you must.

Capital Gain Tax Worksheet 2020

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. V/ see the instructions for line.

Qualified Dividends Worksheet 2024

Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. This worksheet helps you calculate the tax on qualified dividends.

Qualified Dividends And Capital Gain Tax Worksheet 2022 Qual

This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Complete this worksheet only if line 18 or line 19 of schedule d is more than.

Qualified Capital Gains Worksheet 2022

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. Use 1 of the following methods to calculate the tax for line 16 of form 1040. This worksheet helps you calculate.

Capital Gains And Dividends Worksheet Printable And Enjoyable Learning

V/ see the instructions for line 16 in the instructions to see if you can use this. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. This worksheet helps you calculate the tax on qualified dividends and capital gains that you. Did you dispose of any investment(s) in a qualified.

Qualified Dividends And Capital Gain Tax Worksheet 2023 Qual

V/ see the instructions for line 16 in the instructions to see if you can use this. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Complete this worksheet only if line 18 or line 19 of schedule d is.

Qualified Dividends And Capital Gains Sheet

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. V/ see the instructions for line 16 in the instructions to.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Use 1 of the following methods to calculate the tax for line.

Qualified Dividends And Capital Gains Sheet

See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions for line 16 in the instructions to see if you can use this. Did you dispose of any investment(s) in a.

V/ See The Instructions For Line 16 In The Instructions To See If You Can Use This.

Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15. This worksheet helps you calculate the tax on qualified dividends and capital gains that you.

See The Instructions For Line 16 To See If You Must Use The Worksheet Below To Figure Your Tax.

Use 1 of the following methods to calculate the tax for line 16 of form 1040.