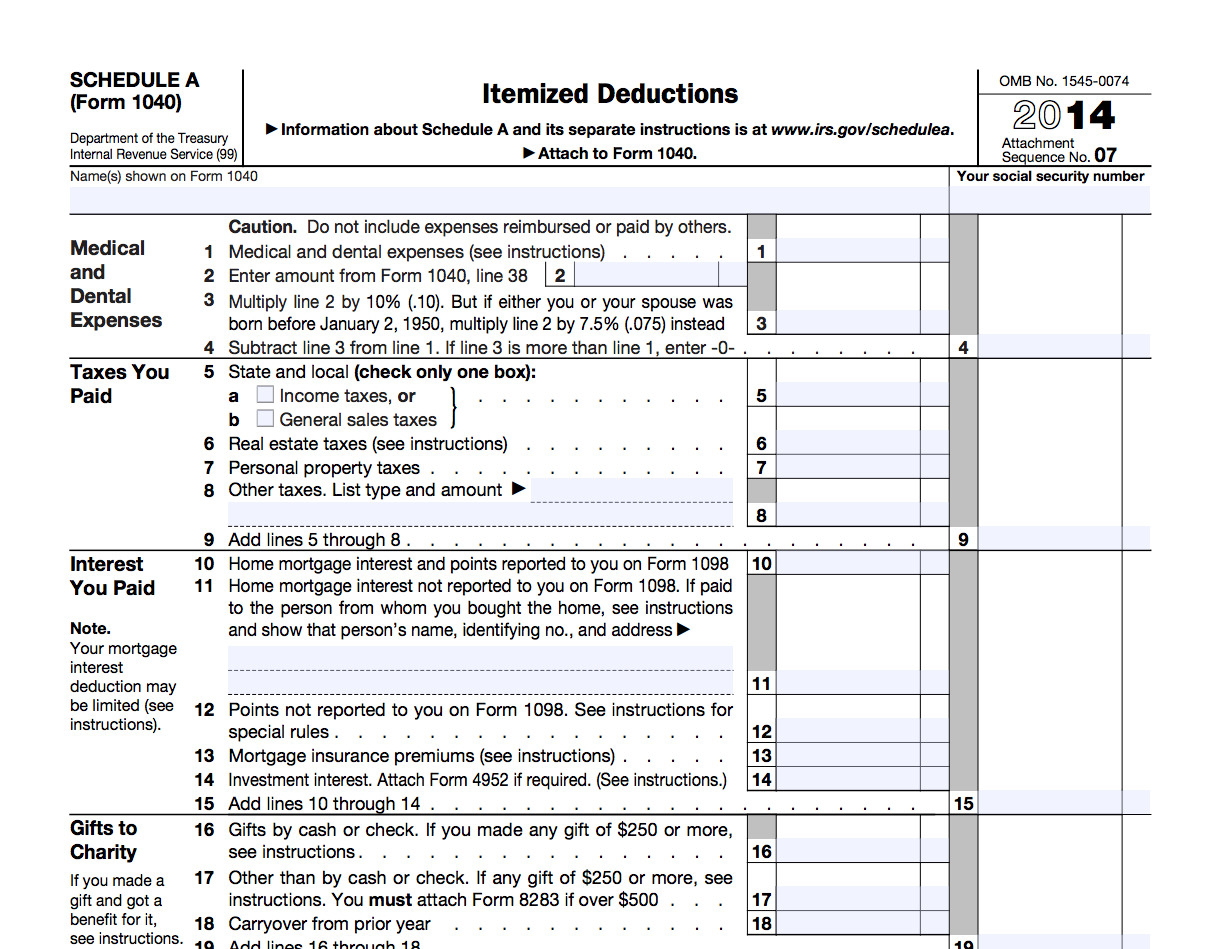

Printable Itemized Deductions Worksheet - We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the larger of your itemized.

If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the larger of your itemized.

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the larger of your itemized. If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):.

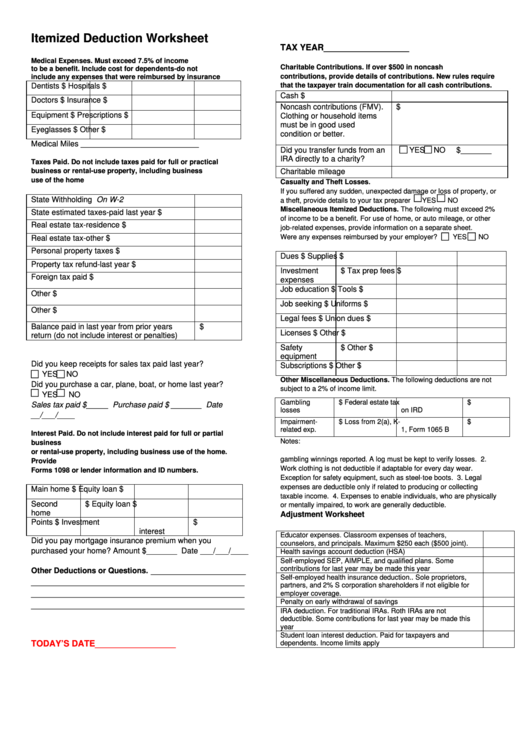

Itemized Deduction Worksheet printable pdf download

Use schedule a (form 1040) to figure your itemized deductions. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. In most cases, your federal income tax will be less if you take the larger of your itemized. We’ll use your 2023 federal standard deduction shown.

Printable Itemized Deductions Worksheet

If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the larger of your itemized. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):..

Printable Itemized Deductions Worksheet

We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Download these income tax.

Itemized Deductions Worksheets

If you elect to itemize deductions even though they are less than your standard deduction, check this box. Use schedule a (form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized. Download these income tax worksheets and organizers to maximize your deductions and minimize errors.

Printable Itemized Deductions Worksheet

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. If you elect to itemize deductions even though they are less than your standard deduction, check this box. We’ll use your 2023 federal standard deduction shown.

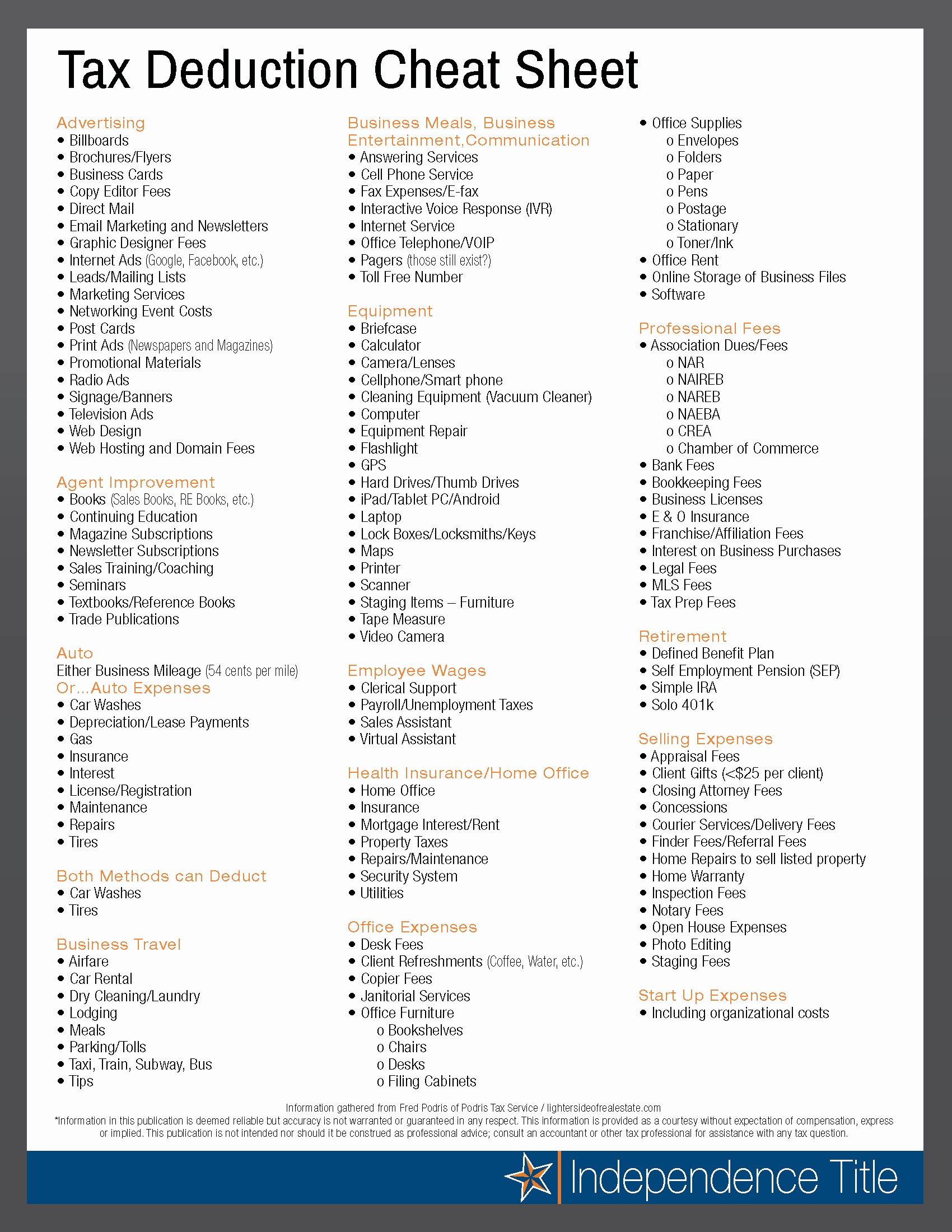

A List Of Itemized Deductions

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you.

Tax Itemized Deductions Worksheet

We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):. In most cases, your federal income tax will be less if you take the. Use schedule a (form 1040) to figure your itemized deductions. If you elect to itemize deductions even though they are less than.

Printable Itemized Deductions Worksheet

Use schedule a (form 1040) to figure your itemized deductions. If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. In most cases, your federal income tax will be less if you take the larger of your itemized..

Printable Itemized Deductions Worksheet

In most cases, your federal income tax will be less if you take the larger of your itemized. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Use schedule a (form 1040) to figure your itemized deductions. If you elect to itemize deductions even though.

Itemized Deductions Worksheet —

We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850.

We’ll Use Your 2022 Federal Standard Deduction Shown Below If More Than Your Itemized Deductions Above (If Blind, Add $1,750 Or $1,400 If Married):.

In most cases, your federal income tax will be less if you take the larger of your itemized. Use schedule a (form 1040) to figure your itemized deductions. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married):.

In Most Cases, Your Federal Income Tax Will Be Less If You Take The.

If you elect to itemize deductions even though they are less than your standard deduction, check this box.