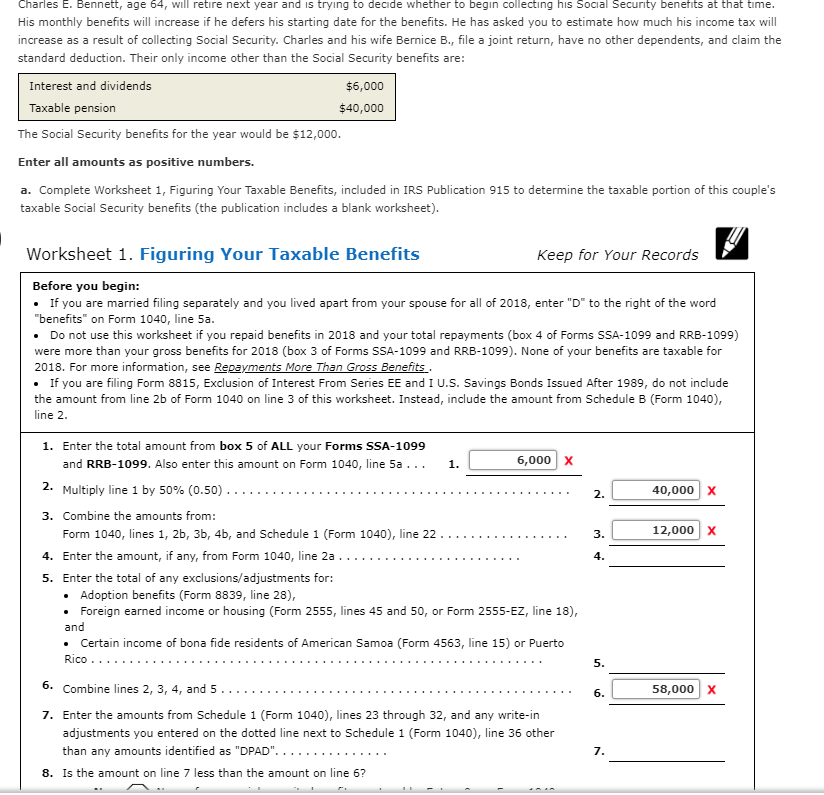

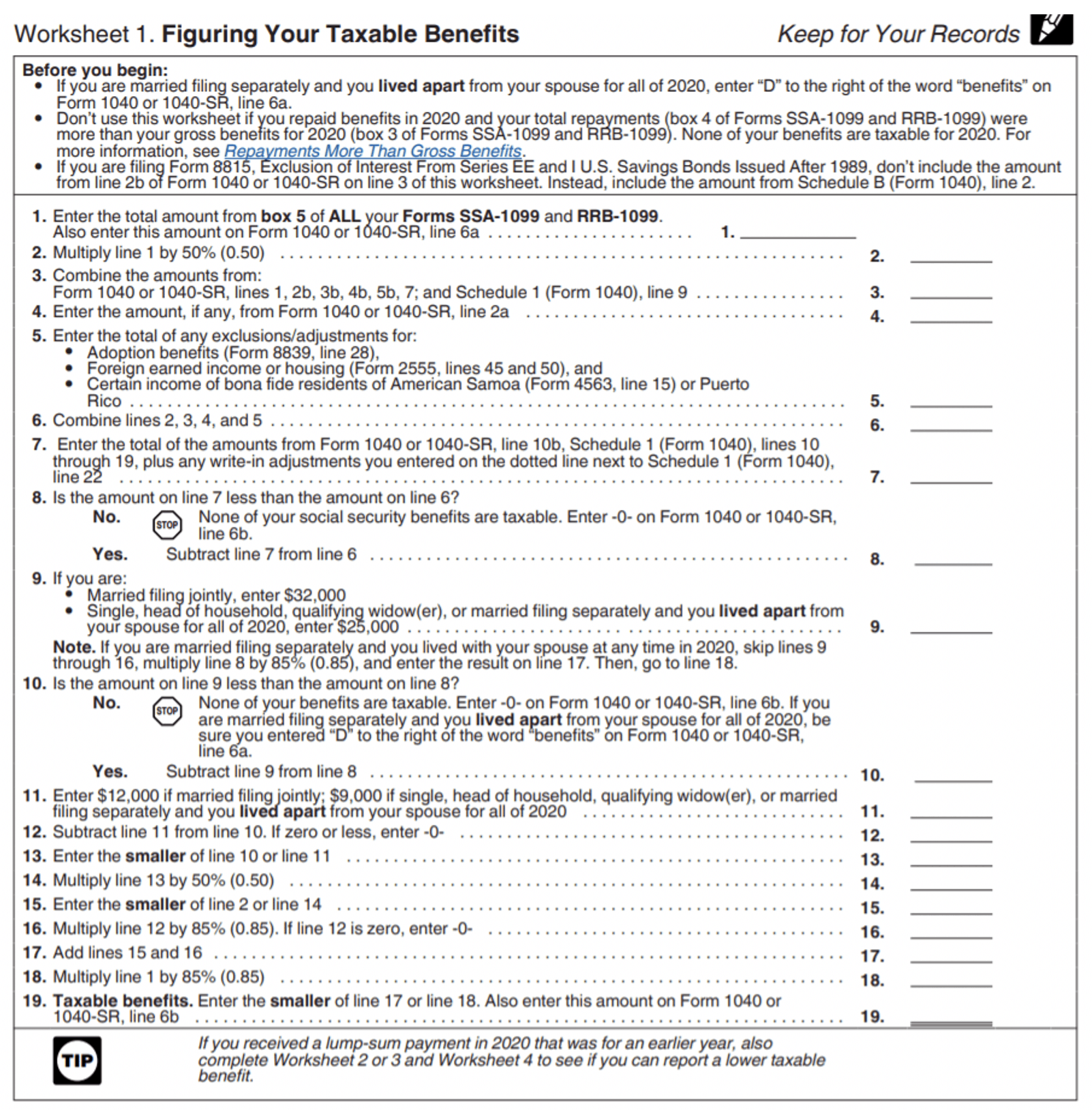

Irs Form 915 Worksheet - Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. This worksheet is based on. V / if you are filing form 8815, exclusion of interest from series ee and i. Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. If you receive benefits on more than one social security record, you may. For more information, see repayments more than gross benefits in pub 915.

Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. V / if you are filing form 8815, exclusion of interest from series ee and i. For more information, see repayments more than gross benefits in pub 915. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. If you receive benefits on more than one social security record, you may. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. This worksheet is based on.

Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. This worksheet is based on. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. V / if you are filing form 8815, exclusion of interest from series ee and i. For more information, see repayments more than gross benefits in pub 915. Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. If you receive benefits on more than one social security record, you may.

Irs Publication 915 Worksheet For 2022

Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning.

Publication 915 Worksheets 2021

Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. V / if you are filing form 8815, exclusion of interest from series ee and i. For more information,.

Irs Form 915 Worksheet

Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. For more information, see repayments more than gross benefits in pub 915. This is an early release draft of.

Publication 915 Worksheet 1 Publication 915 Worksheets 2020

V / if you are filing form 8815, exclusion of interest from series ee and i. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. Rather than requiring you to file amended returns for those years,.

Irs 915 Worksheet 1

If you receive benefits on more than one social security record, you may. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. V / if you are filing form 8815, exclusion of interest from series ee.

Publication 915 Worksheets 2021

V / if you are filing form 8815, exclusion of interest from series ee and i. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Irs publication 915, social security.

Irs Worksheet For Determining Support

This worksheet is based on. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. Rather than requiring you to file amended returns for those years, the irs allows you to handle.

Social Security Worksheets 2020

This worksheet is based on. V / if you are filing form 8815, exclusion of interest from series ee and i. For more information, see repayments more than gross benefits in pub 915. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. If you receive benefits on.

Social Security Benefits Worksheet

Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. For more information, see repayments more than gross benefits in pub 915. This worksheet is based on. V / if you are.

Publication 915 Worksheet 1 Publication 915 Worksheets 2020

Irs publication 915, social security and equivalent railroad retirement benefits provides information concerning the taxability of. V / if you are filing form 8815, exclusion of interest from series ee and i. Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. Rather than requiring you to file amended returns for those years,.

Irs Publication 915, Social Security And Equivalent Railroad Retirement Benefits Provides Information Concerning The Taxability Of.

Information on publication 915, social security and equivalent railroad retirement benefits, including recent updates and related forms. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. If you receive benefits on more than one social security record, you may. V / if you are filing form 8815, exclusion of interest from series ee and i.

For More Information, See Repayments More Than Gross Benefits In Pub 915.

Rather than requiring you to file amended returns for those years, the irs allows you to handle it all on your current tax return, using. This worksheet is based on.