Housing Allowance Worksheet - Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Amount actually spent for housing this year: The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. Clergy housing allowance worksheet tax return for year 200____ note: This worksheet is provided for educational purposes only. Find out the conditions, limits and. Down payment on purchase of primary. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Clergy housing allowance worksheet method 1:

Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Amount actually spent for housing this year: Find out the conditions, limits and. Down payment on purchase of primary. Clergy housing allowance worksheet tax return for year 200____ note: This worksheet is provided for educational purposes only. The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). Clergy housing allowance worksheet method 1: The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation.

This worksheet is provided for educational purposes only. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Amount actually spent for housing this year: The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). Clergy housing allowance worksheet method 1: Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. Clergy housing allowance worksheet tax return for year 200____ note: Down payment on purchase of primary. Find out the conditions, limits and.

41 Clergy Housing Allowance Worksheet Combining Like Terms Worksheet

The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Down payment on purchase of primary. Amount actually spent for housing this year: Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Clergy housing allowance.

Clergy Housing Allowance Worksheet 2023 Printable Word Searches

This worksheet is provided for educational purposes only. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Find out the conditions, limits and. Amount actually spent for housing this year: Down payment on purchase of primary.

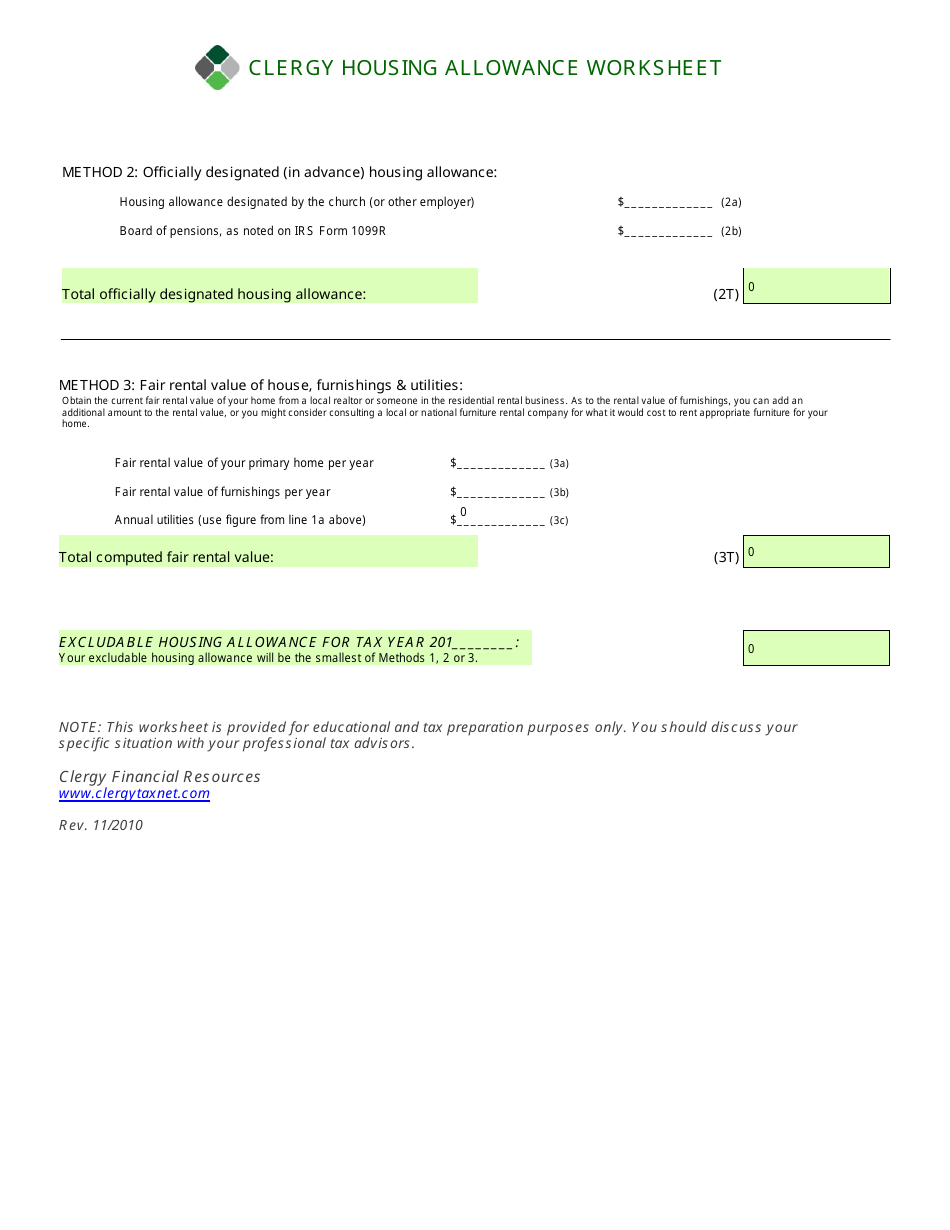

Housing Allowance Worksheet Clergy Financial Resources Download

Find out the conditions, limits and. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. Cash housing allowance payments made prior.

Housing allowance worksheet for pastors who live in a parsonage

Amount actually spent for housing this year: Clergy housing allowance worksheet method 1: The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). This worksheet is provided for educational purposes only. Find out the conditions, limits and.

Fillable Online Housing Allowance Worksheet For Ministers of the

Clergy housing allowance worksheet method 1: Find out the conditions, limits and. Down payment on purchase of primary. Clergy housing allowance worksheet tax return for year 200____ note: The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation.

Housing Allowance Worksheet

The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. Find out the conditions, limits and. Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Clergy housing allowance worksheet method 1: Amount actually spent for.

Housing Allowance Worksheet 2022 Printable Word Searches

Clergy housing allowance worksheet method 1: This worksheet is provided for educational purposes only. The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Amount actually spent for housing this year: The church should provide to its eligible pastors and ministers a housing allowance worksheet so.

Clergy Housing Allowance Worksheet 2024 40 Clergy Tax Deduct

Find out the conditions, limits and. Amount actually spent for housing this year: Clergy housing allowance worksheet tax return for year 200____ note: This worksheet is provided for educational purposes only. Clergy housing allowance worksheet method 1:

Clergy Housing Allowance Worksheet 2024 40 Clergy Tax Deduct

Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Clergy housing allowance worksheet method 1: The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). Down payment on purchase of primary. Amount actually spent for housing this year:

Clergy Housing Allowance Worksheet 2024 40 Clergy Tax Deduct

The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for. Down payment on purchase of primary. The amount excludable from income for federal income tax purposes is the lower of a or b (or reasonable compensation). The figures on this worksheet are to be used to.

This Worksheet Is Provided For Educational Purposes Only.

The figures on this worksheet are to be used to help figure the actual housing allowance and utilities & furnishings allowance for compensation allocation. Clergy housing allowance worksheet tax return for year 200____ note: Find out the conditions, limits and. Clergy housing allowance worksheet method 1:

The Amount Excludable From Income For Federal Income Tax Purposes Is The Lower Of A Or B (Or Reasonable Compensation).

Cash housing allowance payments made prior to a designation of the housing allowance are fully taxable for income tax purposes. Down payment on purchase of primary. Amount actually spent for housing this year: The church should provide to its eligible pastors and ministers a housing allowance worksheet so that the individual may request a certain amount for.