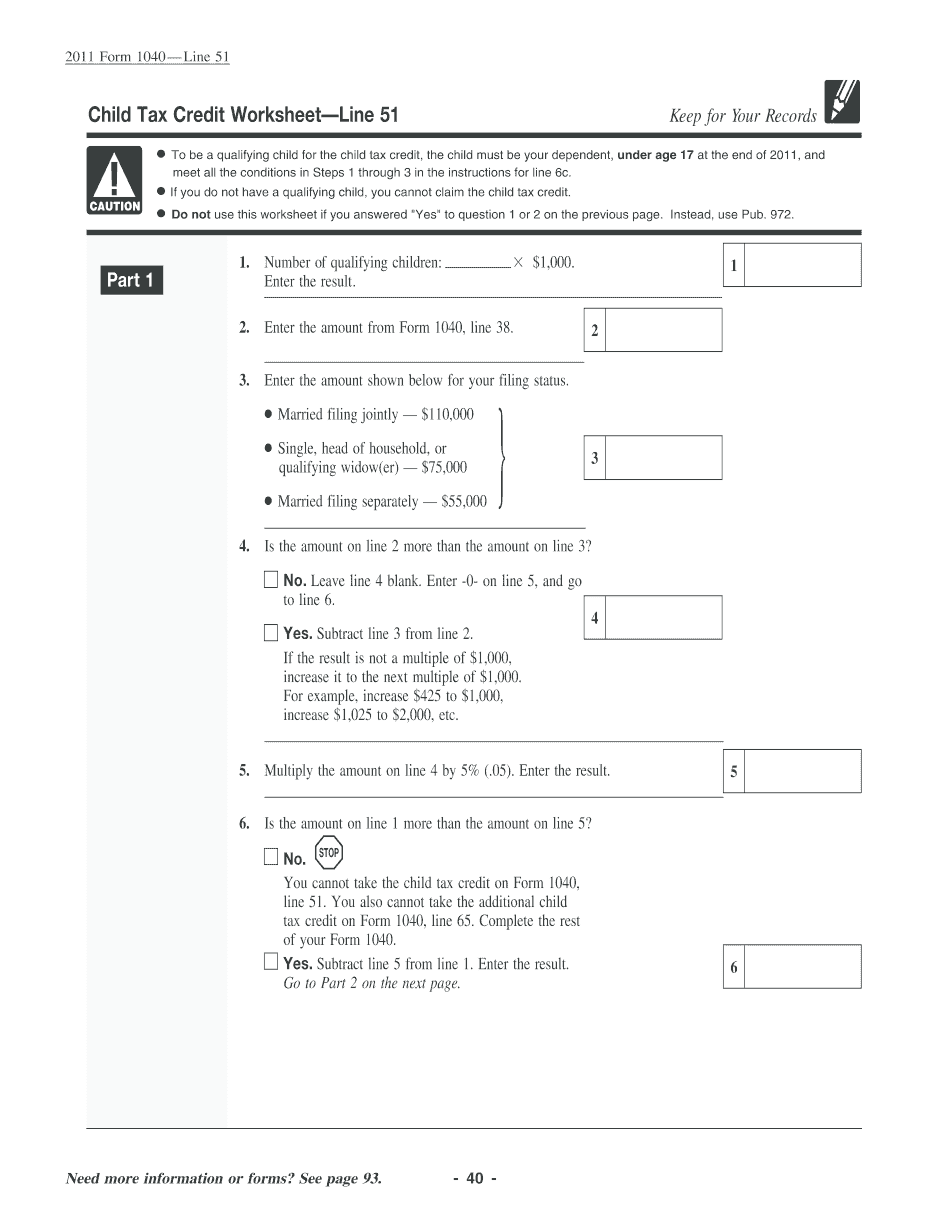

Form 8812 Line 5 Worksheet - Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

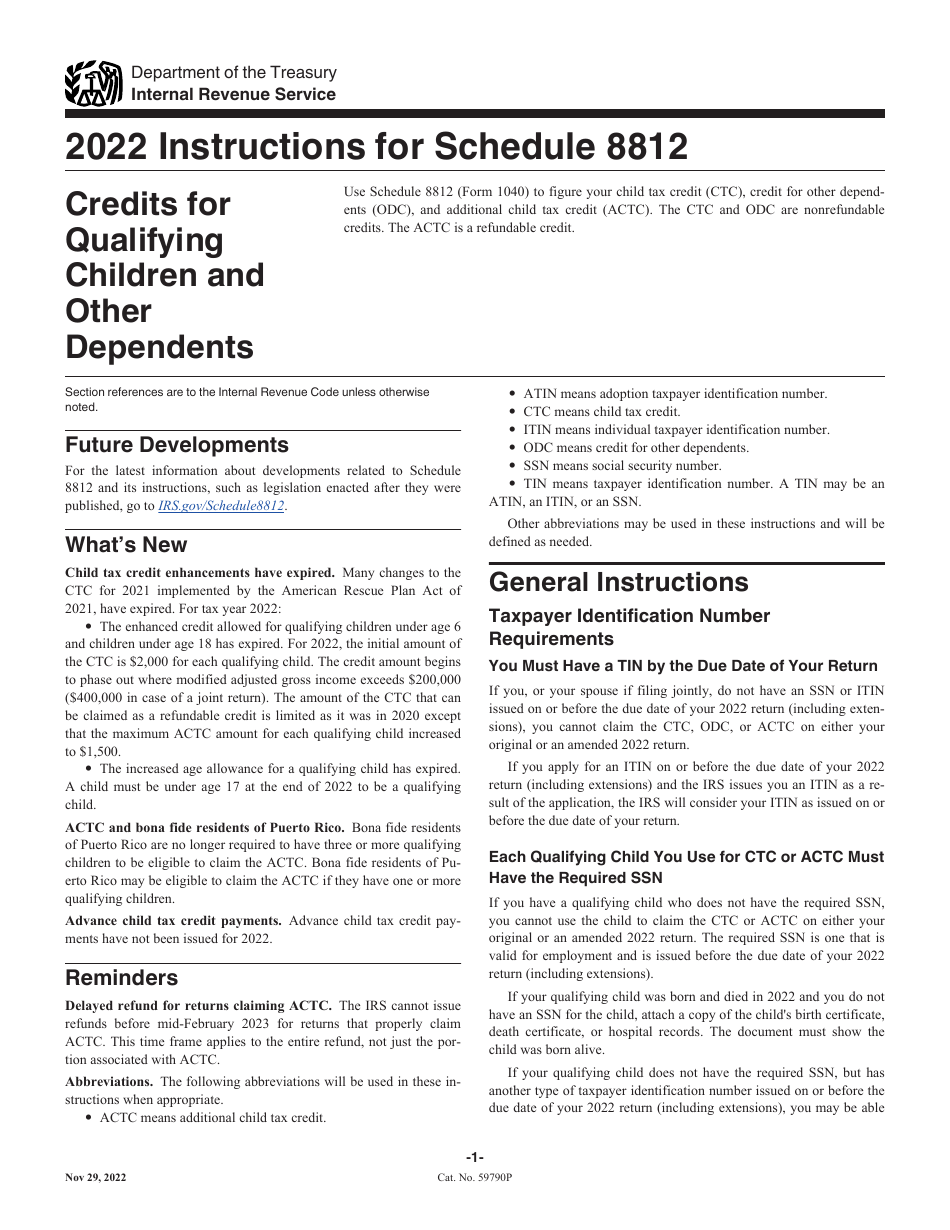

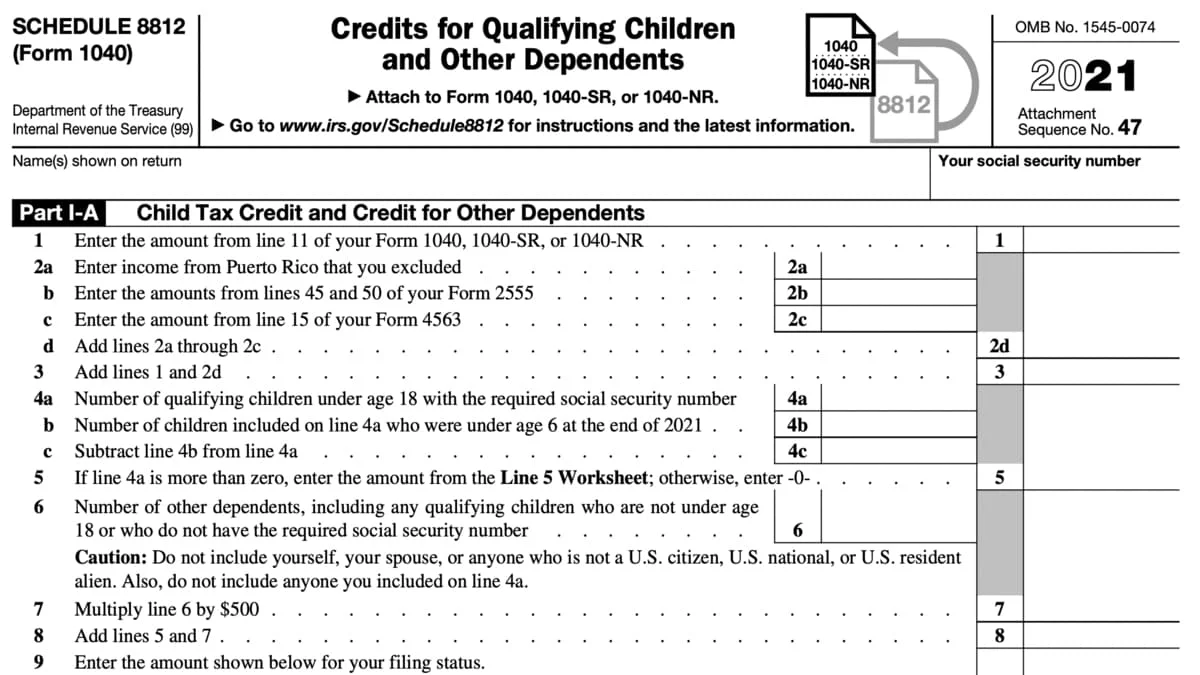

Download Instructions for IRS Form 1040 Schedule 8812 Credits for

In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

2021 Line 5 Worksheet Form 8812

In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

Form 8812 Line 5 Worksheet

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

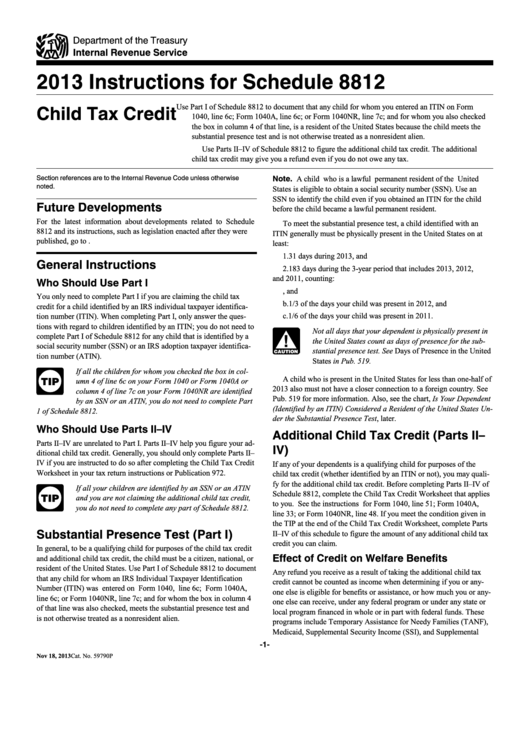

IRS Form 1040 Schedule 8812 (2021) Credits for Qualifying Children

In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

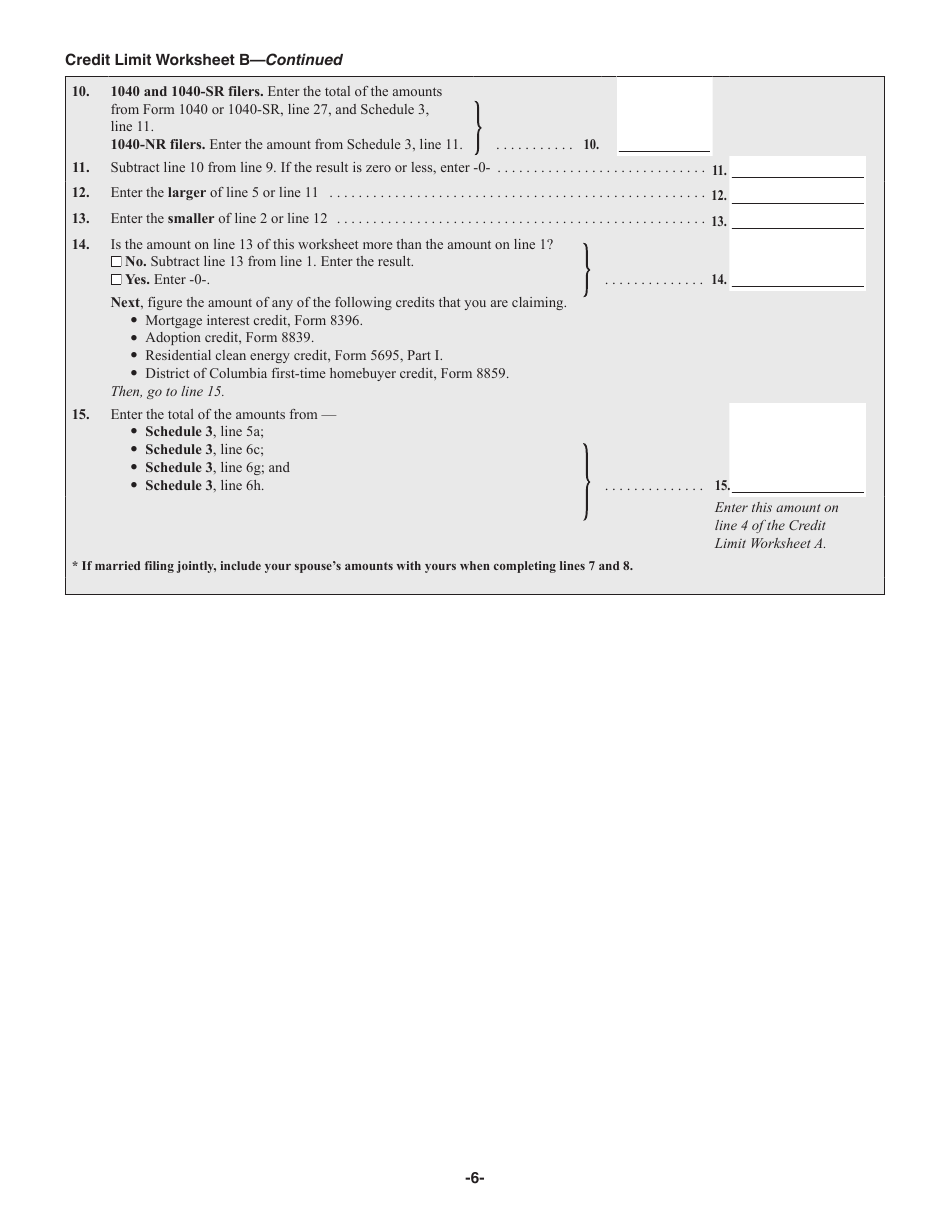

Child Tax Credit Limit Worksheet A 2021

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

Irs Form 8812 2021 Line 5 Worksheet

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Line 5 Worksheet Form 8812 2021

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Schedule 8812 2022 for Child Tax Credit File Online Schedules TaxUni

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

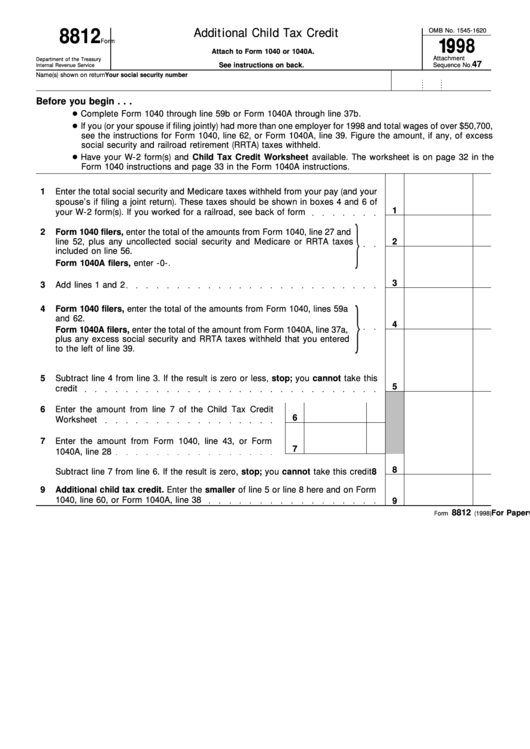

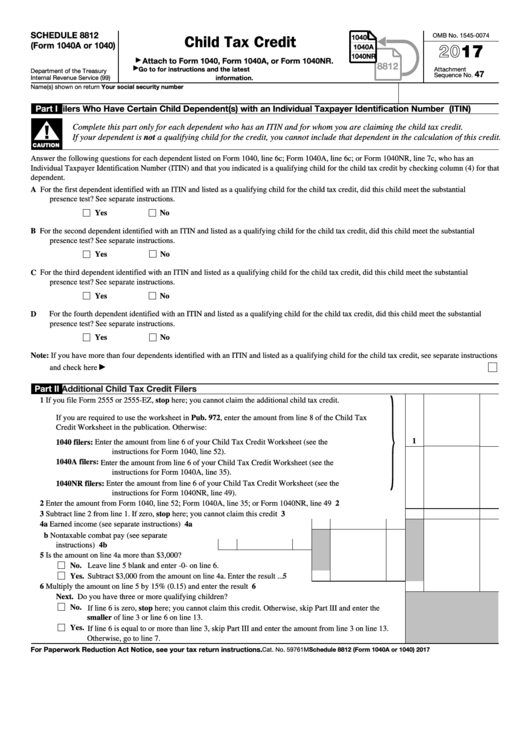

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

Download Instructions for IRS Form 1040 Schedule 8812 Credits for

In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

In The Meantime, I Decided To Fill Out The Forms Via Paper As An Educational Exercise.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.