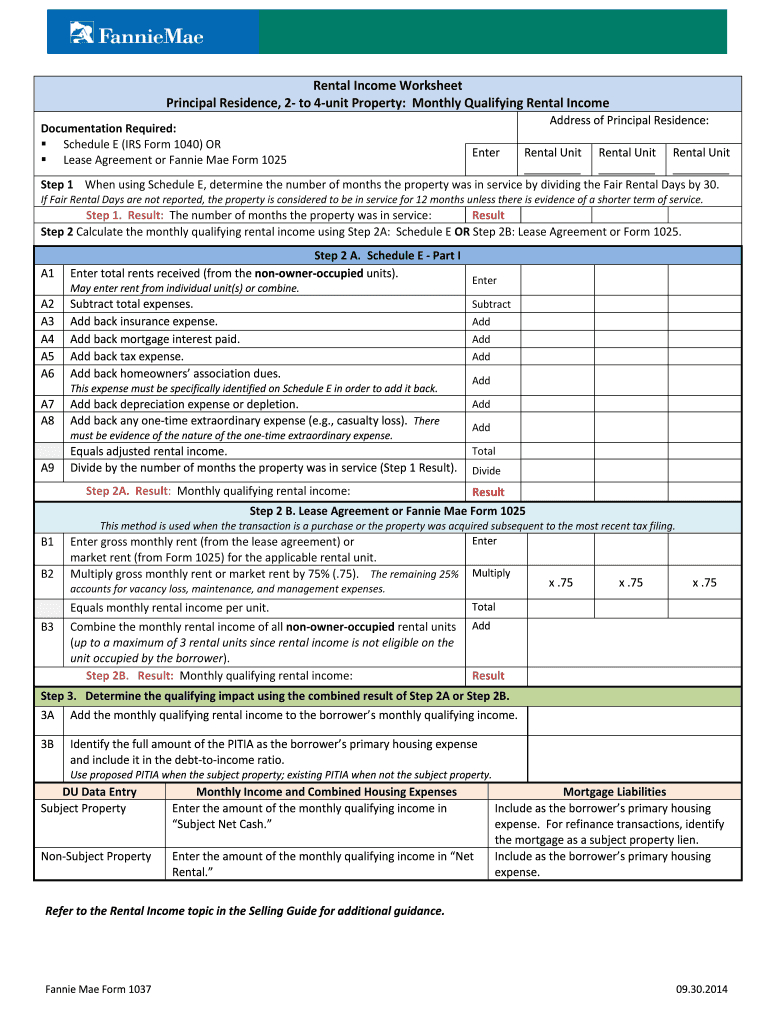

Essent Rental Income Worksheet - Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Calculate monthly qualifying rental income (loss) using step 2a: Ordinary income, net rental income: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Schedule e or step 2b: Lease agreement or fannie mae form 1007 or form. Use our excel calculators to easily total your. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains.

Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Lease agreement or fannie mae form 1007 or form. Calculate monthly qualifying rental income (loss) using step 2a: Ordinary income, net rental income: Use our excel calculators to easily total your. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently.

Ordinary income, net rental income: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Schedule e or step 2b: Calculate monthly qualifying rental income (loss) using step 2a: Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Lease agreement or fannie mae form 1007 or form. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Use our excel calculators to easily total your.

Rental Schedule "E"asy Essent Mortgage Insurance

Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Lease agreement or fannie mae form 1007 or form. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Calculate monthly qualifying rental income (loss) using step 2a: Ordinary income, net rental income:

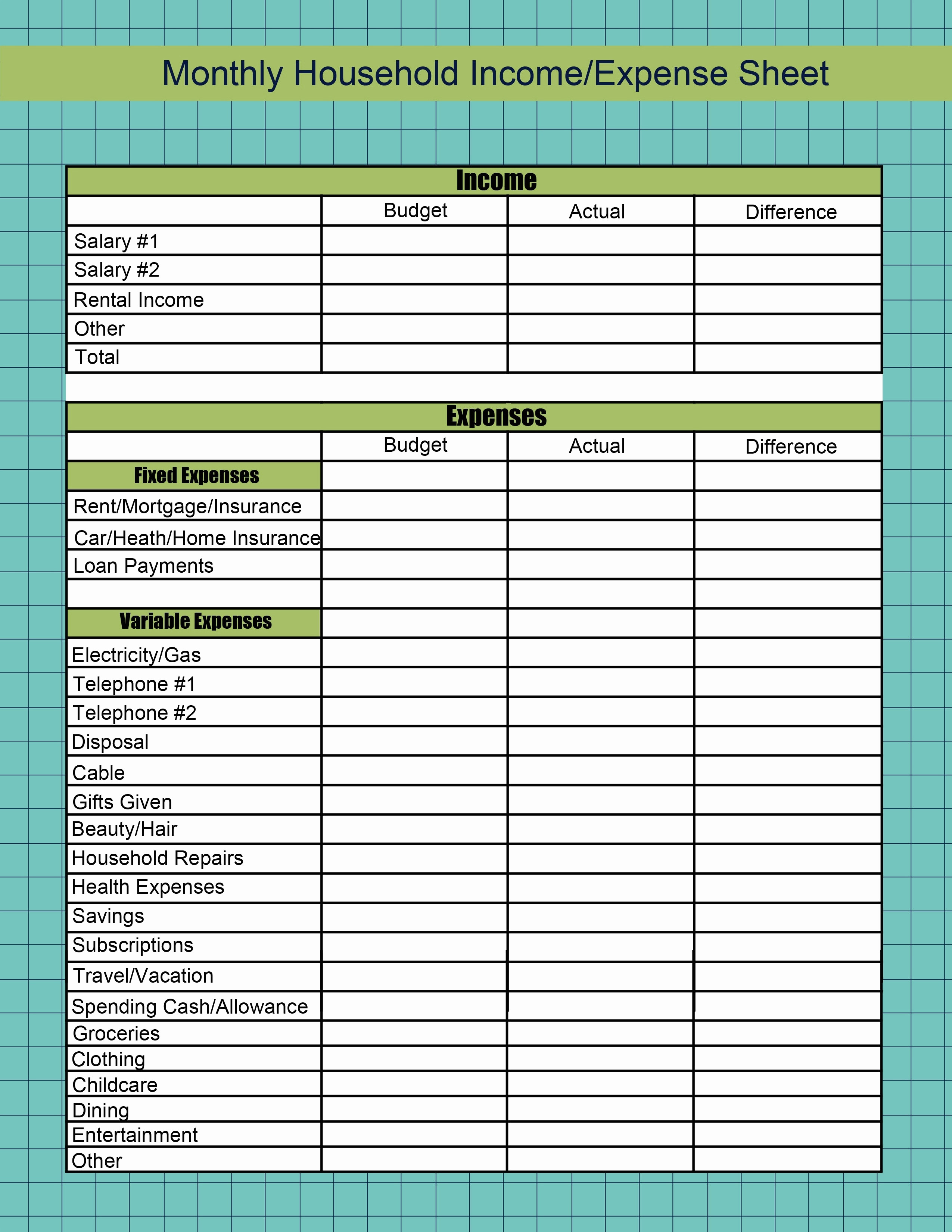

Rental And Expense Worksheet Pdf Fill and Sign Printable

Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Ordinary income, net rental income: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Calculate monthly qualifying rental income (loss) using step 2a: Use our excel calculators to easily total your.

Rental Calculation Worksheet Fill Online, Printable

Schedule e or step 2b: Lease agreement or fannie mae form 1007 or form. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Ordinary income, net rental income: Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property.

Essent Rental Worksheet Printable Word Searches

Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Ordinary income, net rental income: Calculate monthly qualifying rental income (loss) using step 2a: Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b:

Rental Expense Worksheet Fill Online, Printable, Fillable

Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Calculate monthly qualifying rental income (loss) using step 2a: Use our excel calculators to easily total your. Schedule e or step 2b: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently.

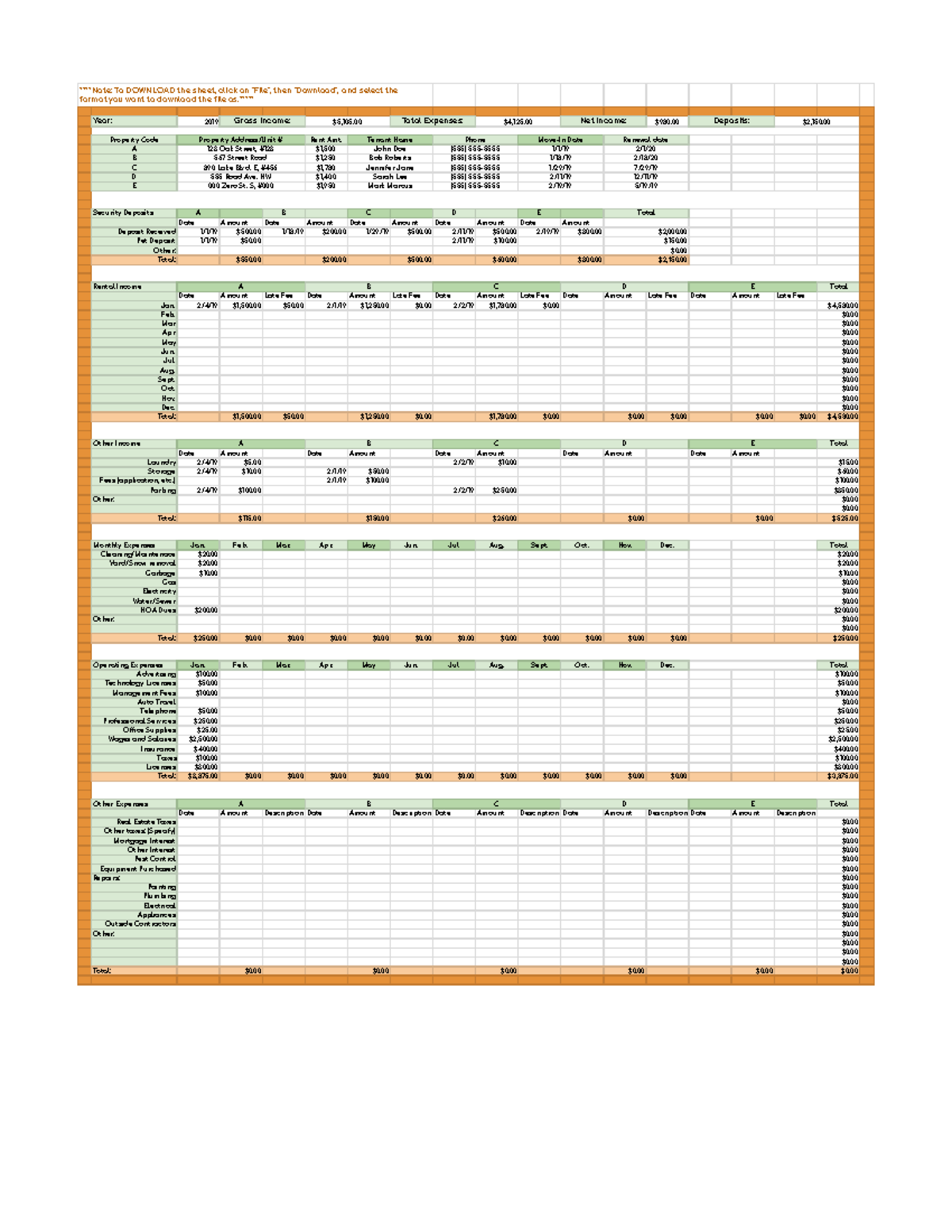

Rental And Expense Worksheet Excel

Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Use our excel calculators to easily total your. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently..

Rental and Expense Worksheet Google Sheets

Calculate monthly qualifying rental income (loss) using step 2a: Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Use our excel calculators to easily total your. Schedule e or step 2b: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently.

Fannie Mae Rental Calc Worksheet

Lease agreement or fannie mae form 1007 or form. Schedule e or step 2b: Use our excel calculators to easily total your. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property.

Rental and Expense Worksheet ****Note To DOWNLOAD the sheet

Calculate monthly qualifying rental income (loss) using step 2a: Use our excel calculators to easily total your. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Schedule e or step 2b: Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property.

Rental And Expense Spreadsheet —

Use our excel calculators to easily total your. Schedule e or step 2b: Lease agreement or fannie mae form 1007 or form. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains.

Use Our Excel Calculators To Easily Total Your.

Ordinary income, net rental income: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Schedule e or step 2b: Calculate monthly qualifying rental income (loss) using step 2a:

Income From Part Nerships, Scorps, Llcs, Estates, Or Trusts Can Only Be Considered If The Lender Obtains.

Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Lease agreement or fannie mae form 1007 or form.