Equity Investments Balance Sheet - It is used when the investor holds significant influence over the investee but does not exercise full control over it, as in the. This financial statement is used both internally and externally to. Web they all relate to the same concept; Web so, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. Locate the company's total assets on the balance sheet for the period. Web 10.3 equity method investments—balance sheet presentation publication date: Ever glanced at your balance sheet and felt. mch bookkeeping on instagram: Likewise, the investor’s share of earnings or losses from an equity method investment should. The balance sheet, together with the. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

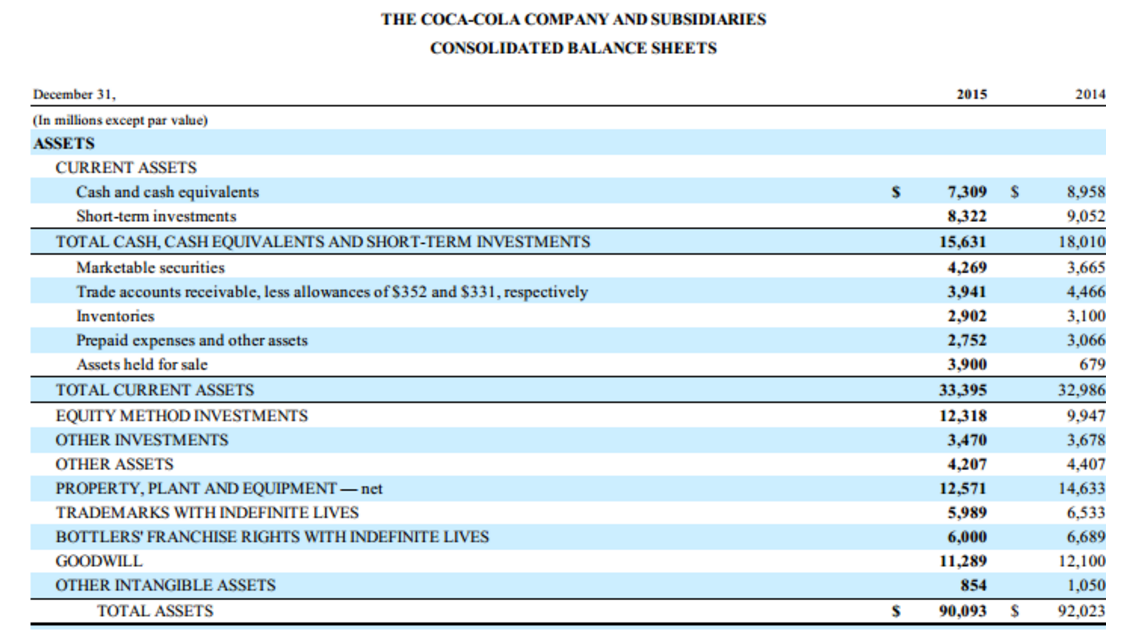

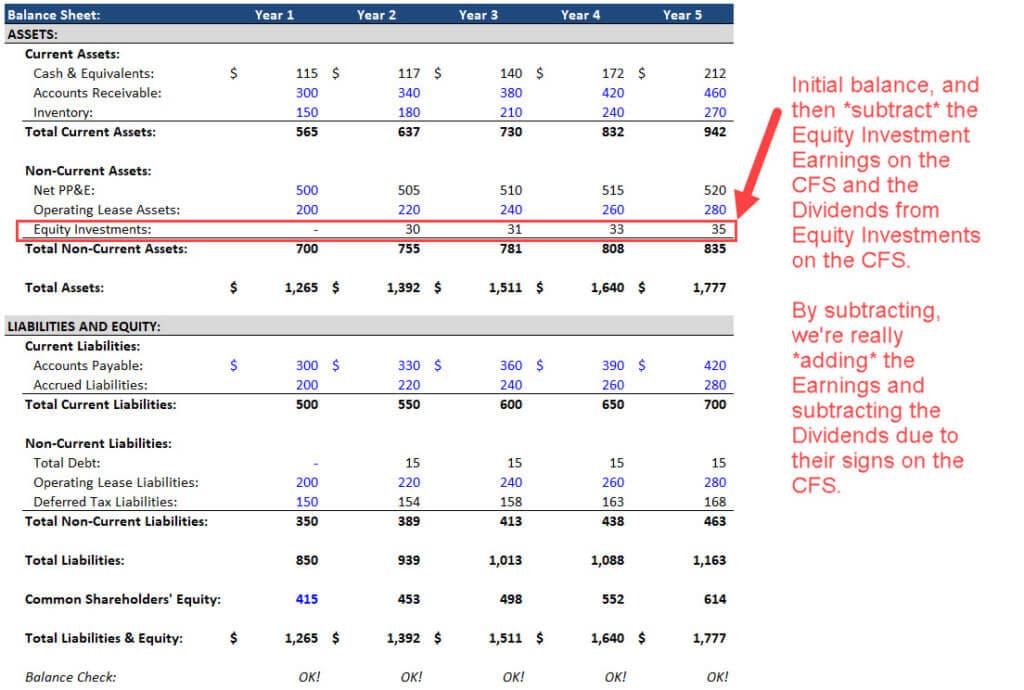

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. These are assets that can be converted to cash. Investments in excess of 50 percent. These parts include assets, liabilities, and equity. The “equity method of accounting” is the process, and the “equity investments” or “associate companies” are the line items created on the balance sheet. If a business owns $10 million in assets and has $3 million in. It is divided into three parts. Web all the information needed to compute a company's shareholder equity is available on its balance sheet. Locate the company's total assets on the balance sheet for the period. Web the equity method is a type of accounting used for intercorporate investments.

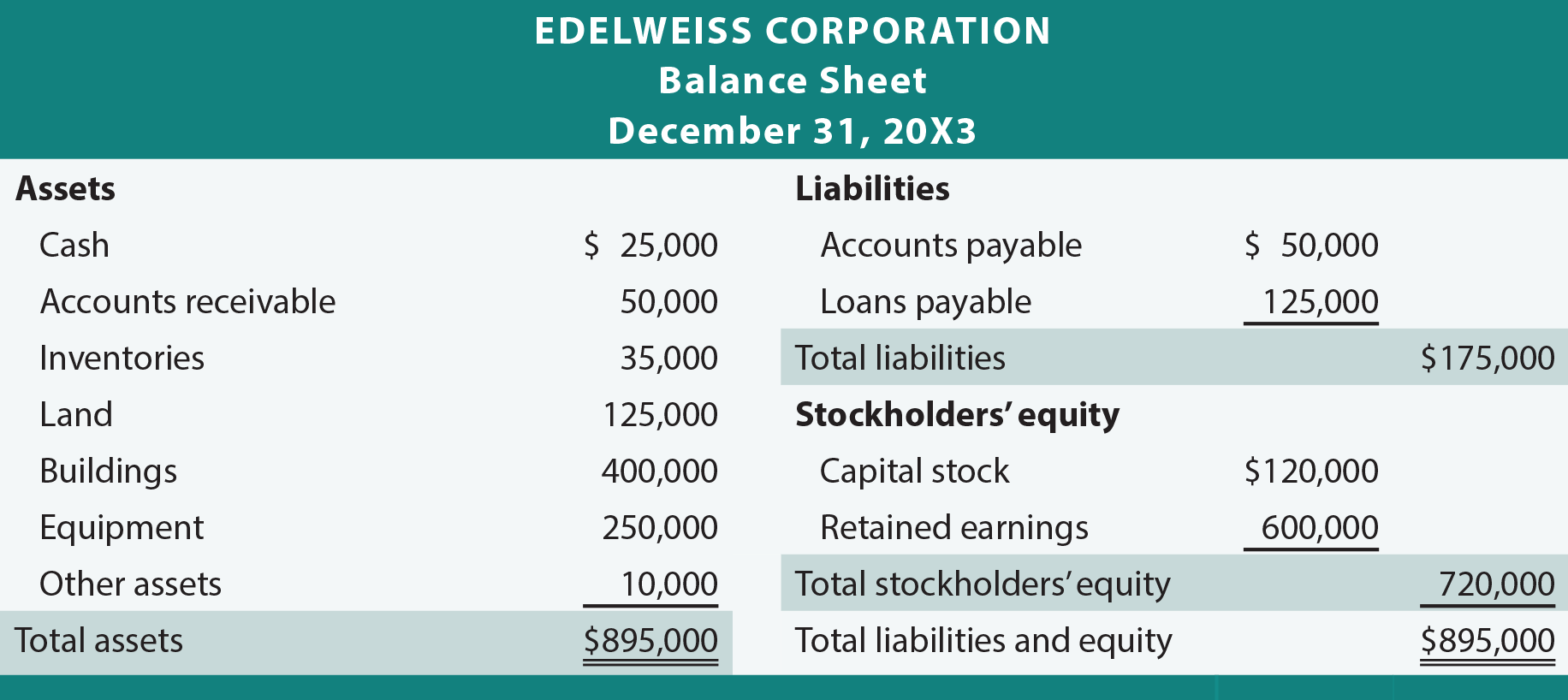

Web overlooking opportunities to attract equity investors may hinder the company's growth and expansion plans. Investments in excess of 50 percent. Unrealized gain on equity investment: Web what is a balance sheet? Likewise, the investor’s share of earnings or losses from an equity method investment should. Web the term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. These are assets that can be converted to cash. Web the equity method is an accounting technique used by a company to record the profits earned through its investment in another company. Web all the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time.

Equity Method of Accounting Excel, Video, and Full Examples

Locate the company's total assets on the balance sheet for the period. Web the balance sheet contains many items, including assets owned by the business, liabilities to be paid by the business, and equity in the financing structures. With the equity method of accounting, the investor. This financial statement is used both internally and externally to. If a business owns.

The Accounting Equation

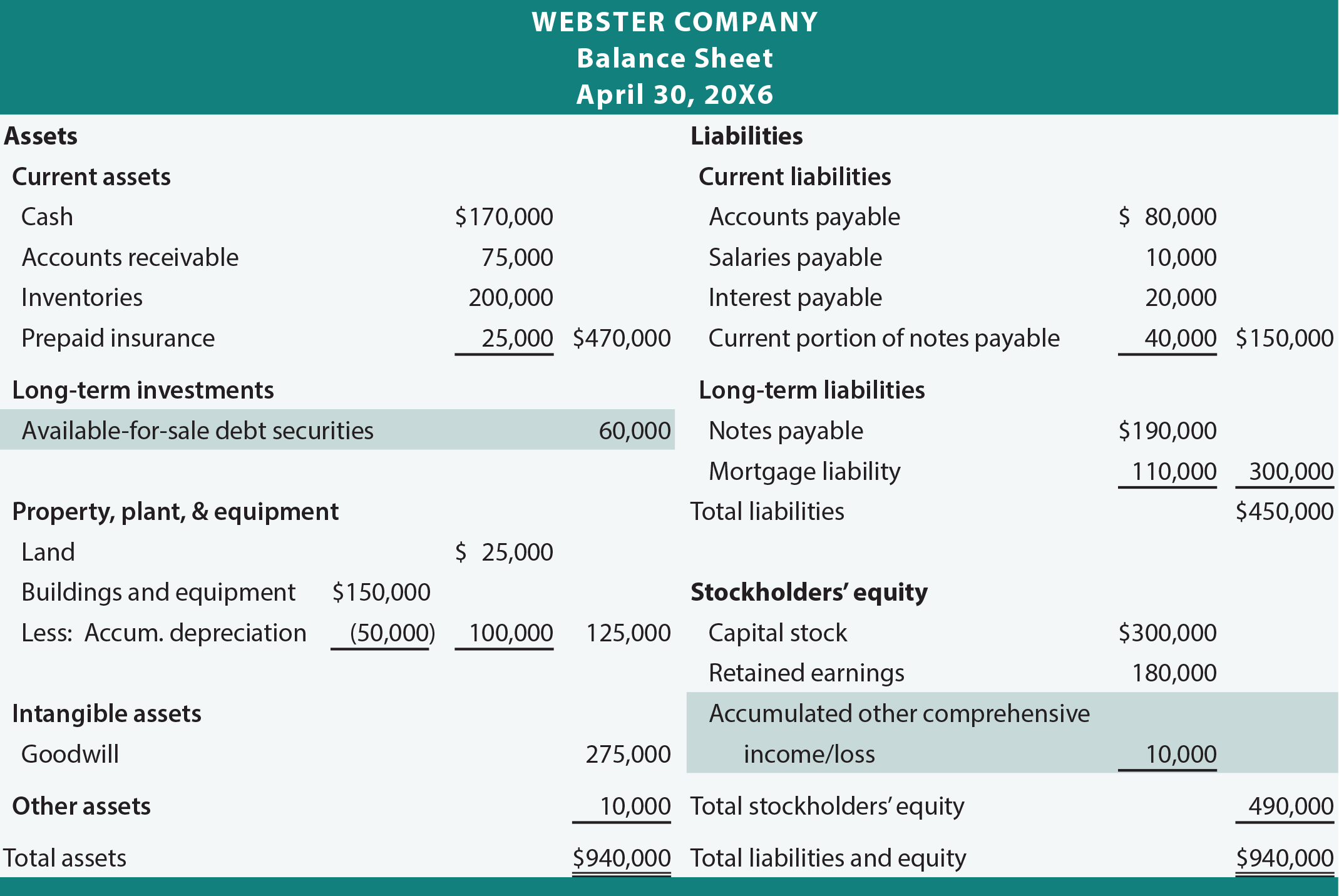

Web in the balance sheet the market value of short‐term available‐for‐sale securities is classified as short‐term investments, also known as marketable securities, and the unrealized gain (loss) account balance of. Web all the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: Web this information can be found on the balance sheet, where.

Balance Sheet Owners Equity Statement Clătită Blog

Web so, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. This financial statement is used both internally and externally to. Web in the balance sheet the market value of short‐term available‐for‐sale securities is classified as short‐term investments, also known as marketable securities, and the unrealized gain.

Debt Securities

Web the equity method is an accounting technique used by a company to record the profits earned through its investment in another company. Web the investment account on the balance sheet should include the investment in common stock, advances, and senior securities consistent with how it is presented in the income statement. Web 10.3 equity method investments—balance sheet presentation publication.

Long Term Investments On Balance Sheet Invest Detroit

Web the investment account on the balance sheet should include the investment in common stock, advances, and senior securities consistent with how it is presented in the income statement. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Web the equity method is an accounting technique used by.

Equity Investments On Balance Sheet Financial Statement Alayneabrahams

The presentation of all these items on a single. Balance sheets provide the basis for. Likewise, the investor’s share of earnings or losses from an equity method investment should. Web the equity method is an accounting technique used by a company to record the profits earned through its investment in another company. It can also be referred to as a.

Divine Summary Financial Statements Definition Management Accounting Ratios

With the equity method of accounting, the investor. Web so, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. It is used when the investor holds significant influence over the investee but does not exercise full control over it, as in the. The success story of tech.

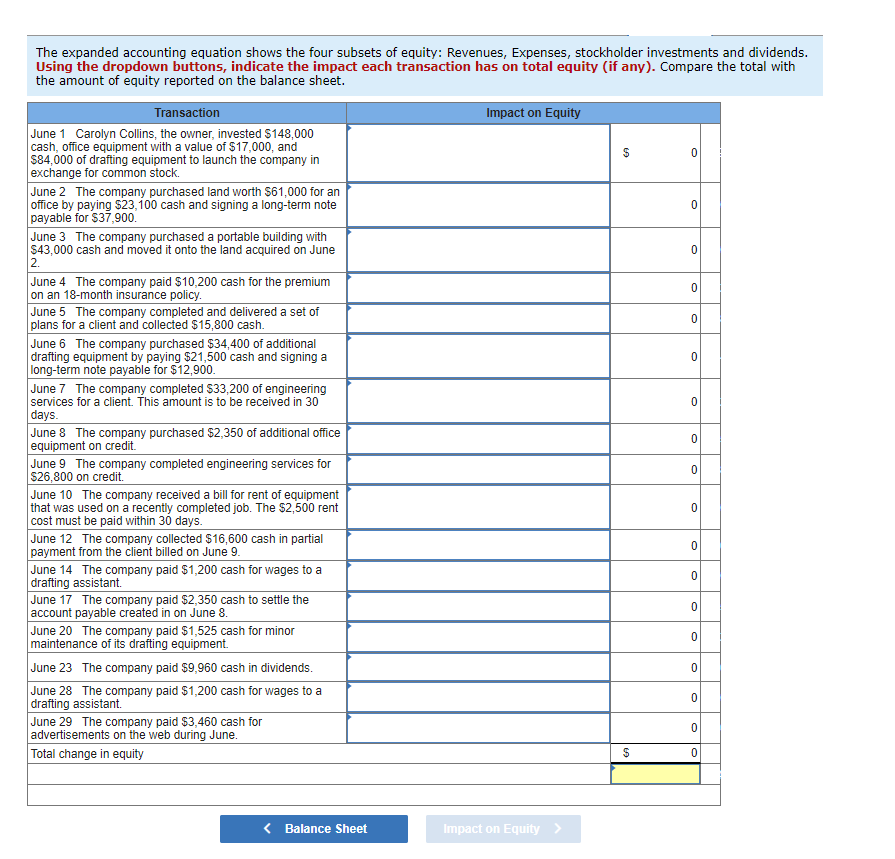

Solved The expanded accounting equation shows the four

Investments in excess of 50 percent. Web in the balance sheet the market value of short‐term available‐for‐sale securities is classified as short‐term investments, also known as marketable securities, and the unrealized gain (loss) account balance of. Web the term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in.

Investment in equity securities The Reynolds Center

Web 10.3 equity method investments—balance sheet presentation publication date: Web the equity method is an accounting technique used by a company to record the profits earned through its investment in another company. Locate the company's total assets on the balance sheet for the period. These are assets that can be converted to cash. Ever glanced at your balance sheet and.

Shareholders Equity (Definition, Equation, Ratios, Examples)

How to forecast balance sheet in excel? Web the balance sheet contains details about the organization's capital structure, liquidity, and viability. Investments in excess of 50 percent. It is calculated by subtracting total liabilities from total assets. It's a summary of how much a company owns in assets, owes in.

Web So, The Simple Answer Of How To Calculate Owner's Equity On A Balance Sheet Is To Subtract A Business' Liabilities From Its Assets.

How to forecast balance sheet in excel? If a business owns $10 million in assets and has $3 million in. Web they all relate to the same concept; Investments in excess of 50 percent.

The Balance Sheet, Together With The.

Web what is a balance sheet? Web a company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). These parts include assets, liabilities, and equity. Unrealized gain on equity investment:

Web The Investment Account On The Balance Sheet Should Include The Investment In Common Stock, Advances, And Senior Securities Consistent With How It Is Presented In The Income Statement.

It is calculated by subtracting total liabilities from total assets. Web all the information needed to compute a company's shareholder equity is available on its balance sheet. Web all the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time.

Web The Term Balance Sheet Refers To A Financial Statement That Reports A Company's Assets, Liabilities, And Shareholder Equity At A Specific Point In Time.

Web the equity method is an accounting technique used by a company to record the profits earned through its investment in another company. Locate the company's total assets on the balance sheet for the period. Web overlooking opportunities to attract equity investors may hinder the company's growth and expansion plans. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)