Cope Insurance Worksheet - This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. When you underwrite an insurance policy, you need information on cope, four key aspects of any property.

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. This article delves into the details of each component, providing a comprehensive understanding of how cope influences.

This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. When you underwrite an insurance policy, you need information on cope, four key aspects of any property.

Fillable Online insurance worksheet Fax Email Print pdfFiller

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. This article delves into the details of each component,.

Printable Cope Note Worksheet

This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Understand how cope information helps insurers.

How much life insurance do I need? [Use our free life insurance worksheet]

This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. When you underwrite an insurance policy, you need information.

Cope Insurance Worksheet Master of Documents

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. This article delves into the details of each component,.

Insurance 101 Worksheet.docx Name Amber Lillge Date 12/3/2020

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. This article delves into the details of each component,.

Cope Insurance Worksheet

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. Understand how cope information helps insurers.

MiniCOPE of clinical wards. Download

When you underwrite an insurance policy, you need information on cope, four key aspects of any property. This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. Cope is an acronym that stands for the four property risk characteristics.

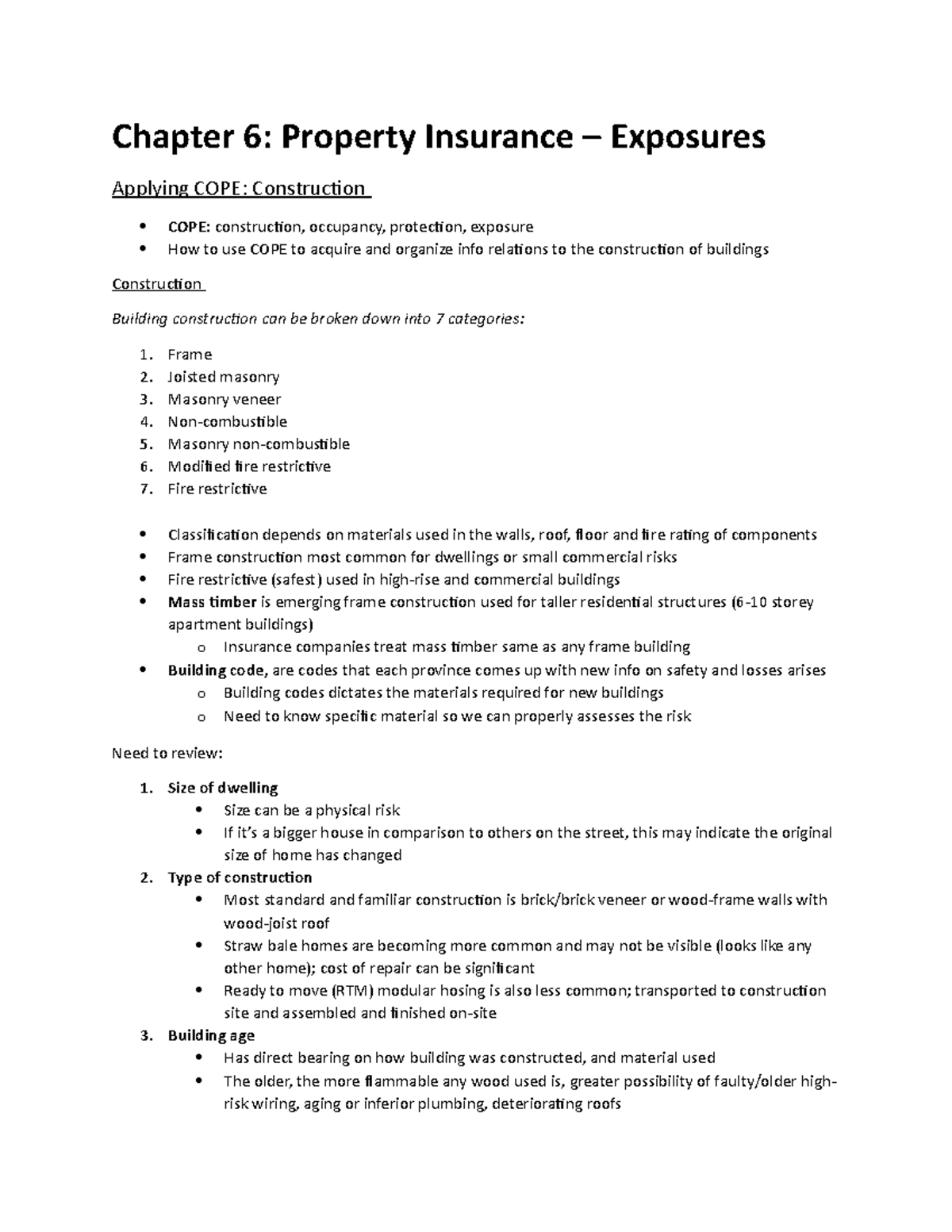

Chapter 6 Chapter 6 Property Insurance Exposures Applying COPE

Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. This article delves into the details of each component, providing a comprehensive understanding of how cope influences. When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Cope is an acronym that stands for the four property risk characteristics.

Cope Ahead Plan

Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. This article delves into the details of each component,.

Cope Insurance Worksheet Printable Word Searches

This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Cope is an acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for. When you underwrite an insurance policy, you need information on cope, four key aspects of any property. Understand how cope information helps insurers.

Cope Is An Acronym That Stands For The Four Property Risk Characteristics An Underwriter Reviews When Evaluating A Submission For.

This article delves into the details of each component, providing a comprehensive understanding of how cope influences. Understand how cope information helps insurers evaluate risk levels, potential losses, and coverage costs. When you underwrite an insurance policy, you need information on cope, four key aspects of any property.

![How much life insurance do I need? [Use our free life insurance worksheet]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/05/how-much-life-insurance-do-you-need.png)