Asc 842 Lease Template Excel - Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Web this excel file shows the basic steps for calculating and posting lessee contracts. Compliance in under 30 days. Asc 842, or topic 842, is the new lease accounting. Determine the lease term under asc 840 step 2: Download and print your commercial lease agreement template today! Upload a few pages from your computer. Easily input data using a pre. Web download our free asc 842 lease accounting calculator and calculate the accounting. Reduce errors & improve accuracy.

Web from the excel workbook, data will need compiled and calculated to arrive. Upload a few pages from your computer. Web this excel file shows the basic steps for calculating and posting lessee contracts. Web larson lease accounting template asc 842. Reduce errors & improve accuracy. Web this video shows you how to use microsoft excel to calculate the lease. Web asc 842 lease amortization schedule. Web with this lease amortization schedule you will be able to : Web technical accounting asc 842 lease classification template for. Web download our free asc 842 lease accounting calculator and calculate the accounting.

Leases standard exploring asc 842: Upload a few pages from your computer. Download and print your commercial lease agreement template today! Determine the lease term under asc 840 step 2: Ad answer simple questions to make a lease agreement on any device in minutes. Ad create a strong commercial lease customized to the parties' needs. Templates for operating and financing leases. Easily input data using a pre. Web larson lease accounting template asc 842. Asc 842, or topic 842, is the new lease accounting.

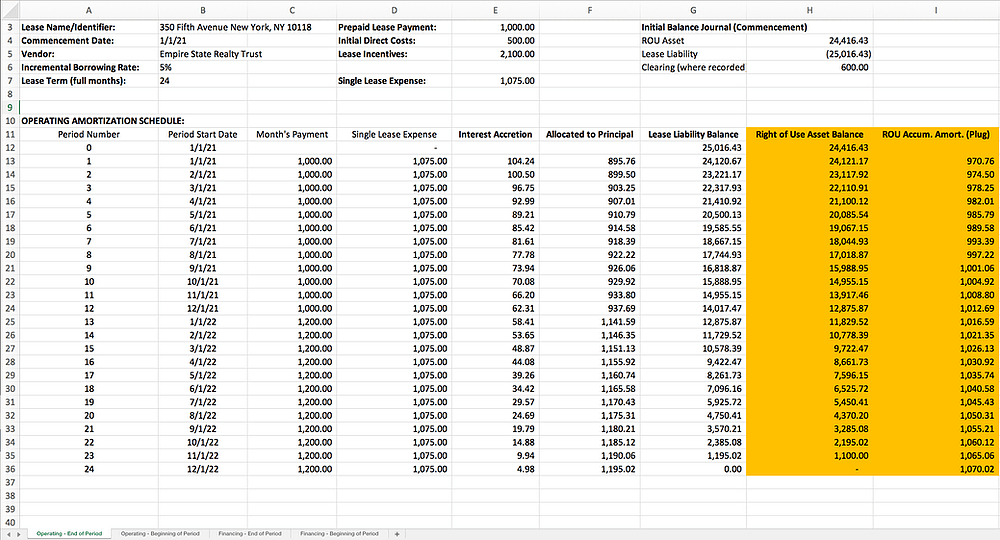

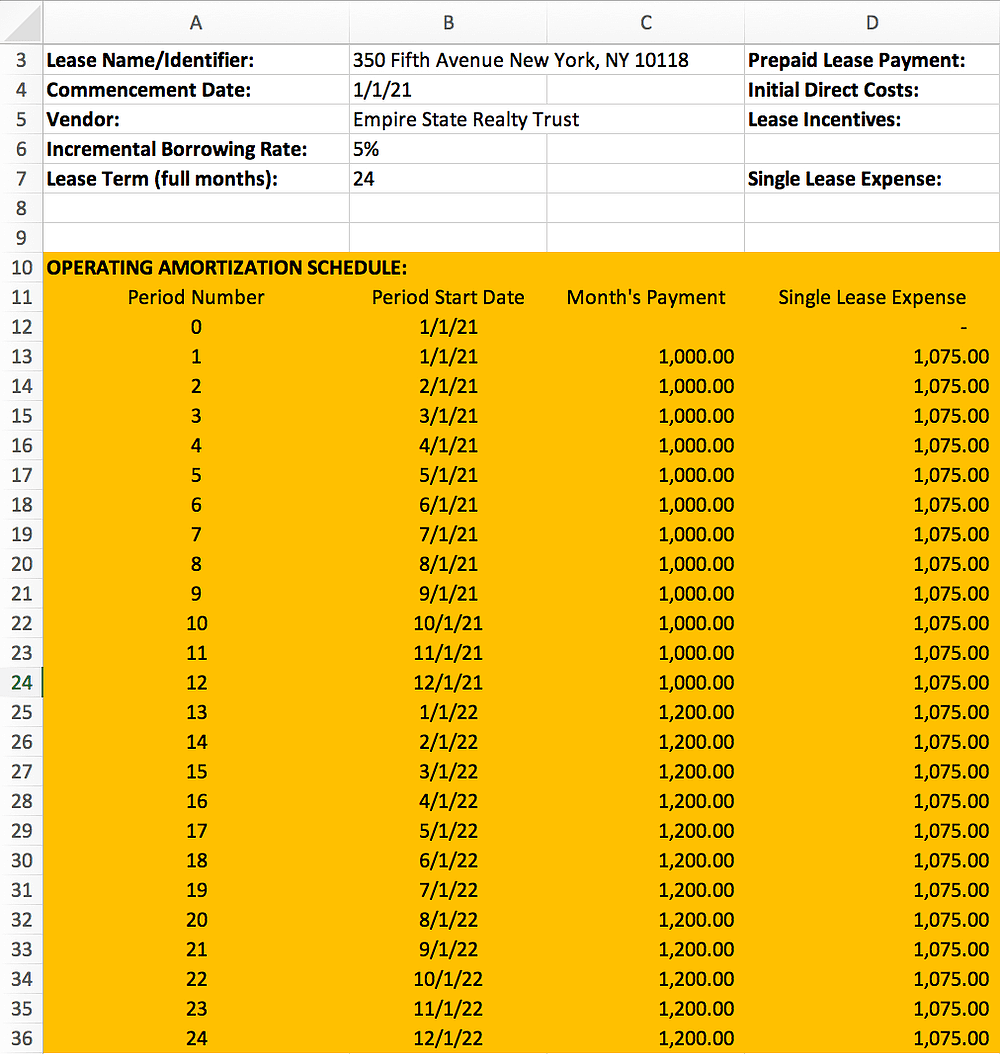

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Upload a few pages from your computer. Web larson lease accounting template asc 842. Web what is asc 842? Leases standard exploring asc 842: Web this video shows you how to use microsoft excel to calculate the lease.

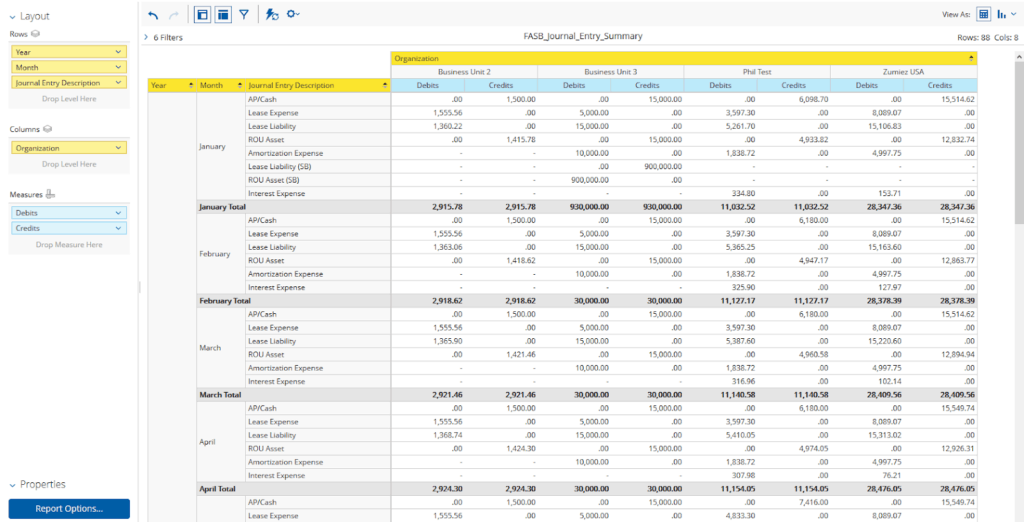

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Compliance in under 30 days. Web larson lease accounting template asc 842. Web this video shows you how to use microsoft excel to calculate the lease. Web with this lease amortization schedule you will be able to : Web a lease liability is required to be calculated for both asc 842 & ifrs 16.

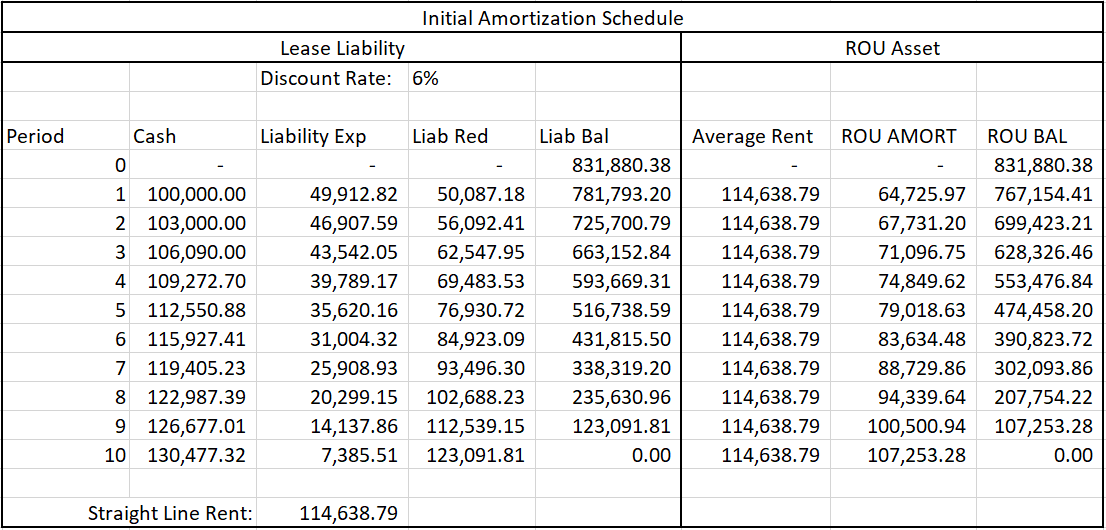

Excel Solution

Web download our free asc 842 lease accounting calculator and calculate the accounting. Web larson lease accounting template asc 842. Easily input data using a pre. Web asc 842 lease amortization schedule. Ad create a strong commercial lease customized to the parties' needs.

Lease Modification Accounting for ASC 842 Operating to Operating

Ad create a strong commercial lease customized to the parties' needs. Web understand how to launch spreadsheet lease: Web this video shows you how to use microsoft excel to calculate the lease. Ad answer simple questions to make a lease agreement on any device in minutes. Web with this lease amortization schedule you will be able to :

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web this excel file shows the basic steps for calculating and posting lessee contracts. Web understand how to launch spreadsheet lease: Ad create a strong commercial lease customized to the parties' needs. Templates for operating and financing leases. Easily input data using a pre.

Favorite Asc 842 Excel Template Google Spreadsheet Personal Commission

Ad create a strong commercial lease customized to the parties' needs. Web technical accounting asc 842 lease classification template for. Compliance in under 30 days. Web larson lease accounting template asc 842. Reduce errors & improve accuracy.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web understand how to launch spreadsheet lease: Easily input data using a pre. Web from the excel workbook, data will need compiled and calculated to arrive. Determine the lease term under asc 840 step 2: Web what is asc 842?

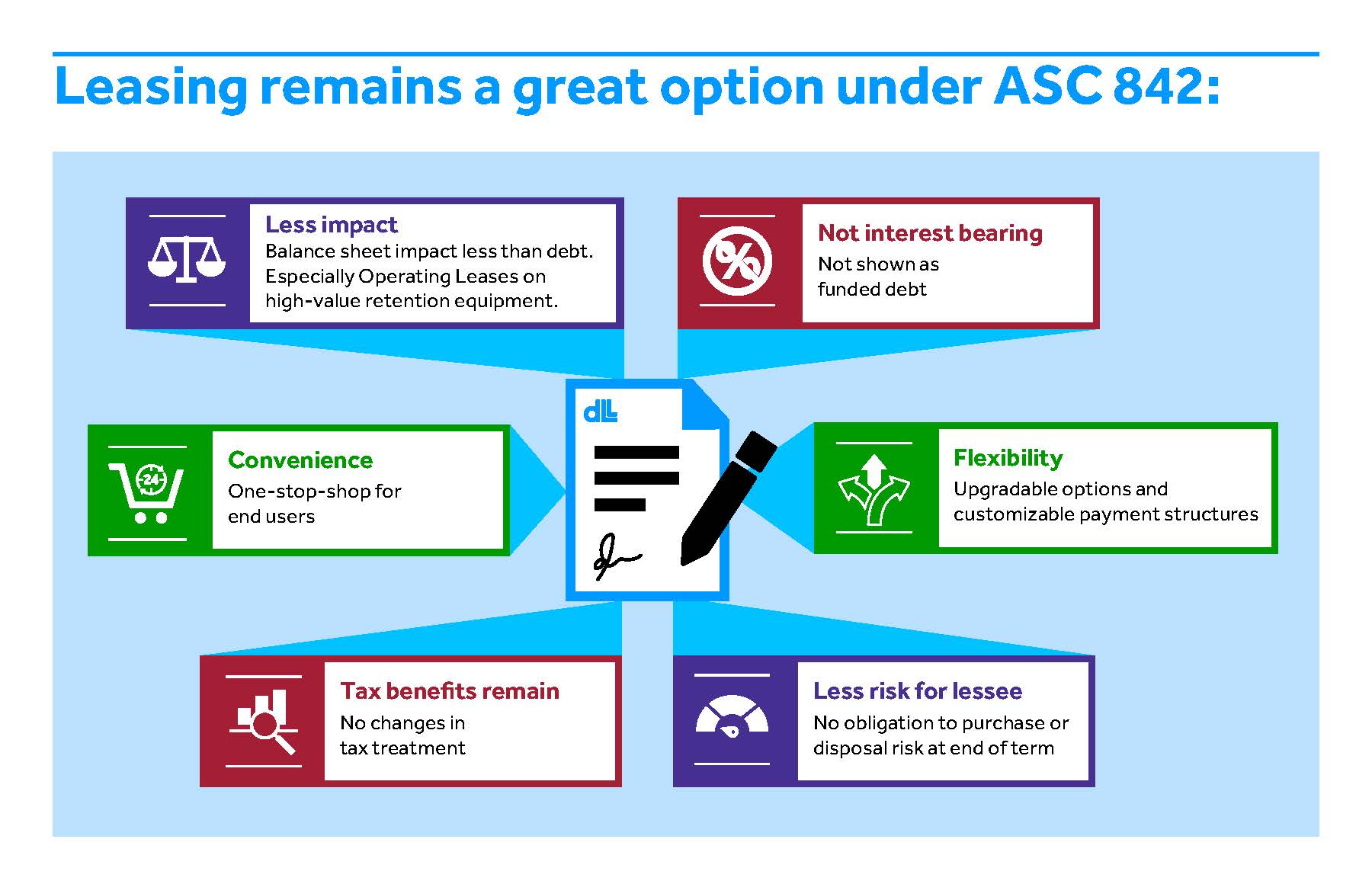

How Your Business Can Prepare for the New Lease Accounting Standards

Web asc 842 lease amortization schedule. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Compliance in under 30 days. Ad answer simple questions to make a lease agreement on any device in minutes. Leases standard exploring asc 842:

ASC 842 Lease Accounting Finance lease, Budget planning, Public company

Web from the excel workbook, data will need compiled and calculated to arrive. Web asc 842 lease amortization schedule. Reduce errors & improve accuracy. Compliance in under 30 days. Web this video shows you how to use microsoft excel to calculate the lease.

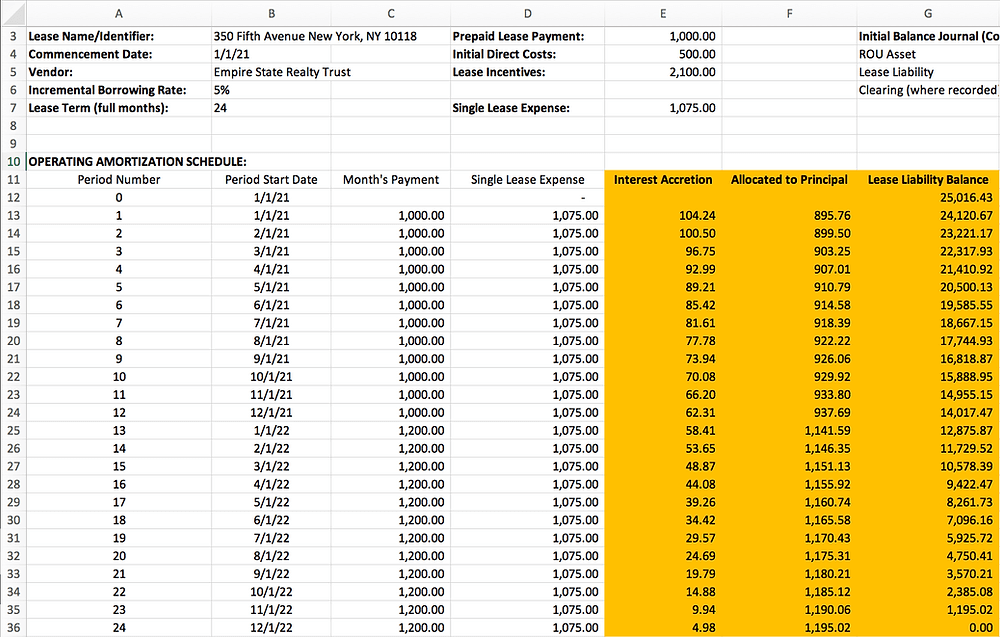

ASC 842 Excel Template Download

Ad answer simple questions to make a lease agreement on any device in minutes. Web download our free asc 842 lease accounting calculator and calculate the accounting. Web technical accounting asc 842 lease classification template for. Web this video shows you how to use microsoft excel to calculate the lease. Web understand how to launch spreadsheet lease:

Web With This Lease Amortization Schedule You Will Be Able To :

Upload a few pages from your computer. Web understand how to launch spreadsheet lease: Ad create a strong commercial lease customized to the parties' needs. Asc 842, or topic 842, is the new lease accounting.

Web Asc 842 Lease Amortization Schedule.

Reduce errors & improve accuracy. Web this video shows you how to use microsoft excel to calculate the lease. Web this excel file shows the basic steps for calculating and posting lessee contracts. Templates for operating and financing leases.

Web Larson Lease Accounting Template Asc 842.

Download and print your commercial lease agreement template today! Compliance in under 30 days. Web what is asc 842? Web from the excel workbook, data will need compiled and calculated to arrive.

Leases Standard Exploring Asc 842:

Determine the lease term under asc 840 step 2: Web download our free asc 842 lease accounting calculator and calculate the accounting. Web technical accounting asc 842 lease classification template for. Web a lease liability is required to be calculated for both asc 842 & ifrs 16.