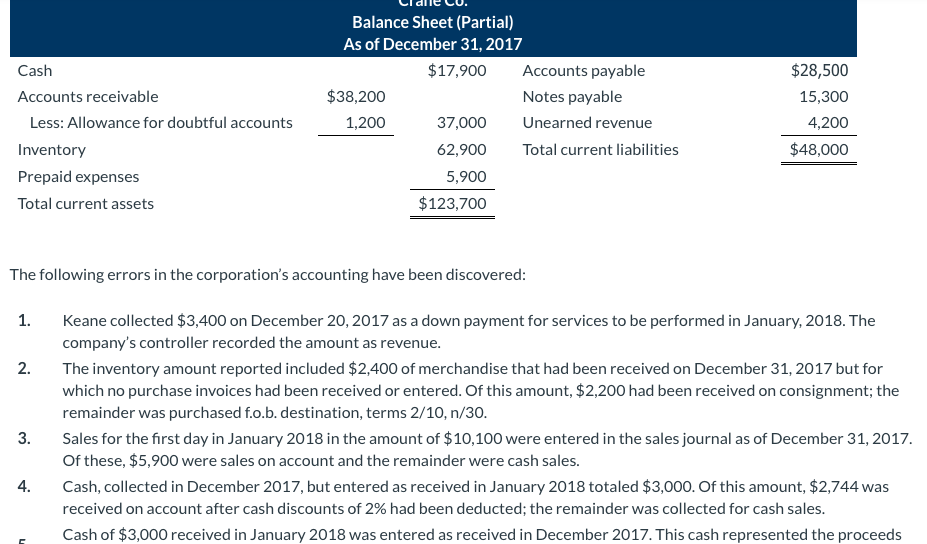

Allowance For Doubtful Accounts On The Balance Sheet Quizlet - A) increases the cash realizable value of accounts receivable. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Debit bad debt expense for $13,000, credit allowance. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. All receivables that are expected to be realized in cash within a year are reported. Web on december 31 the allowance account showed a credit balance of $3,000. B) appears under the heading other assets. c) is offset against total current assets. If the desired ending balance is $13,000, what adjusting entry should be made? Web allowance for doubtful accounts on the balance sheet: Web the allowance for doubful accounts is debited and accounts receivable is credited.

Debit bad debt expense for $13,000, credit allowance. All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubful accounts is debited and accounts receivable is credited. If the desired ending balance is $13,000, what adjusting entry should be made? Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. B) appears under the heading other assets. c) is offset against total current assets. Web allowance for doubtful accounts on the balance sheet: Web on december 31 the allowance account showed a credit balance of $3,000. A) increases the cash realizable value of accounts receivable.

Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. B) appears under the heading other assets. c) is offset against total current assets. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Debit bad debt expense for $13,000, credit allowance. A) increases the cash realizable value of accounts receivable. Web the allowance for doubful accounts is debited and accounts receivable is credited. Web allowance for doubtful accounts on the balance sheet: If the desired ending balance is $13,000, what adjusting entry should be made? Web on december 31 the allowance account showed a credit balance of $3,000. All receivables that are expected to be realized in cash within a year are reported.

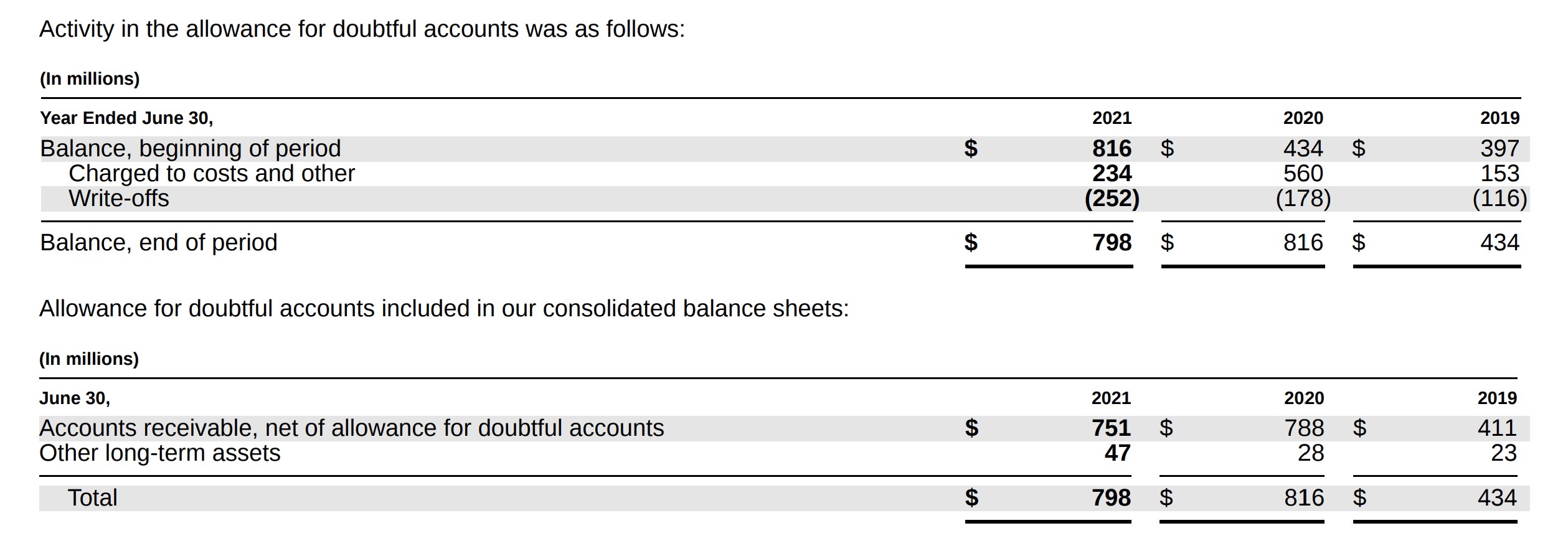

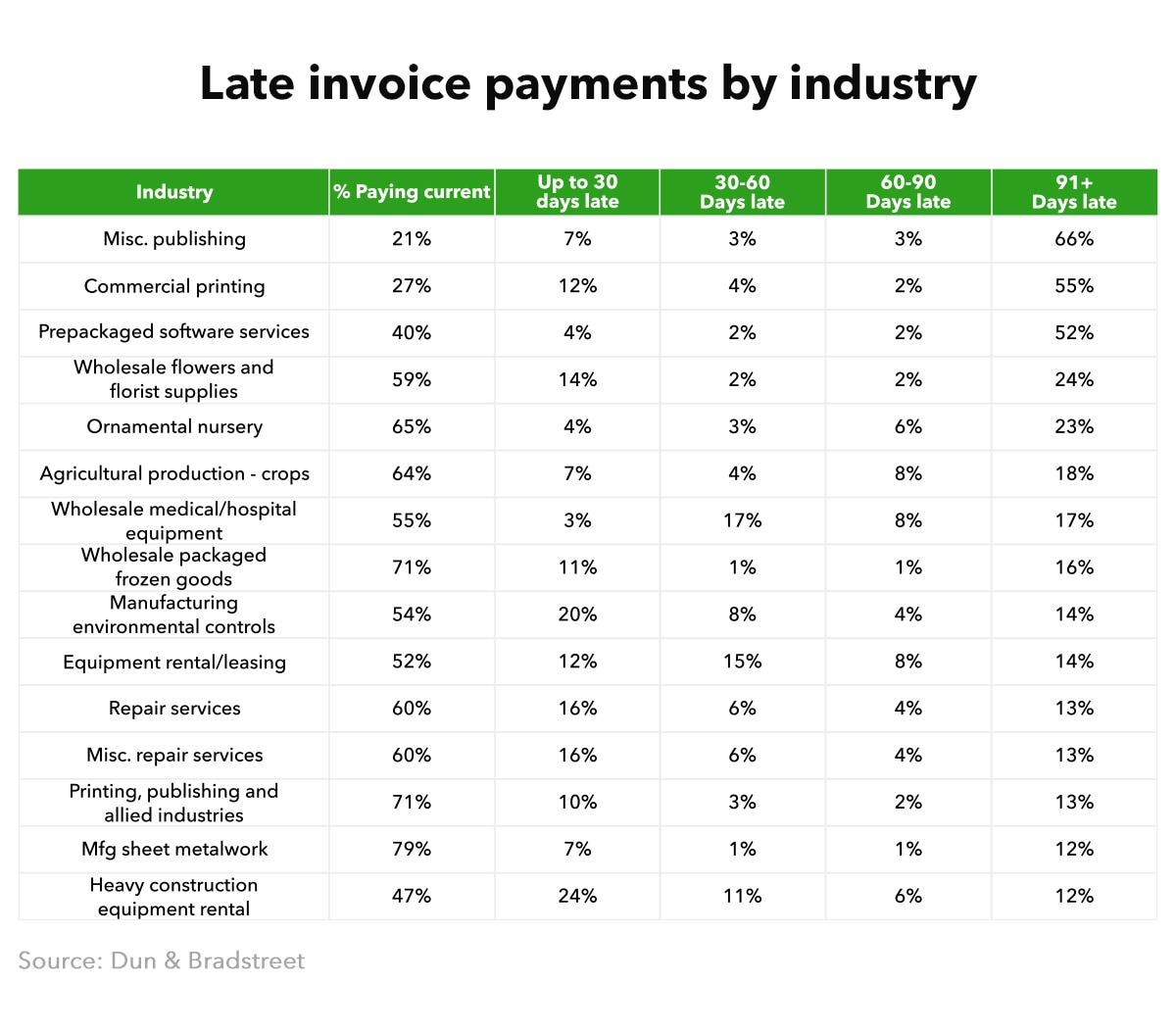

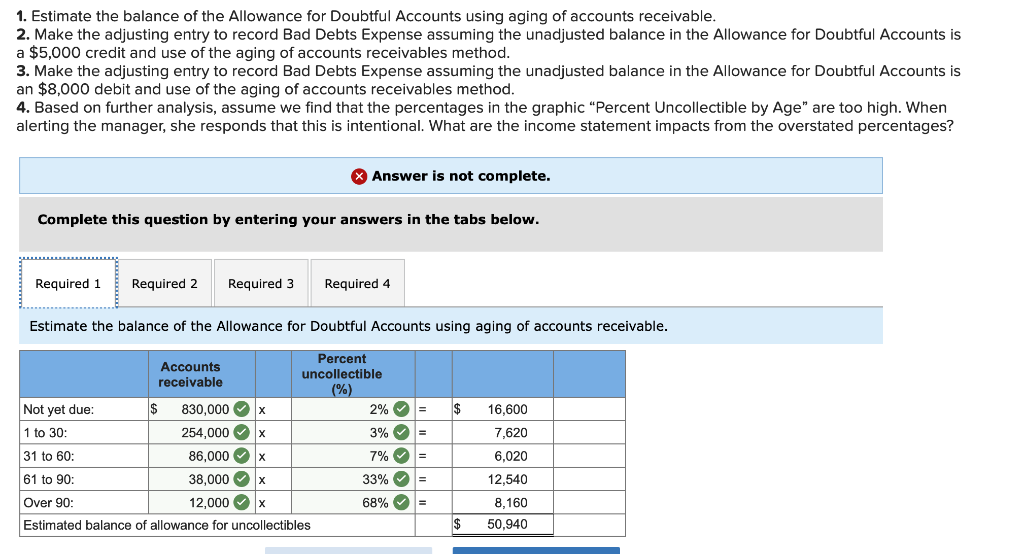

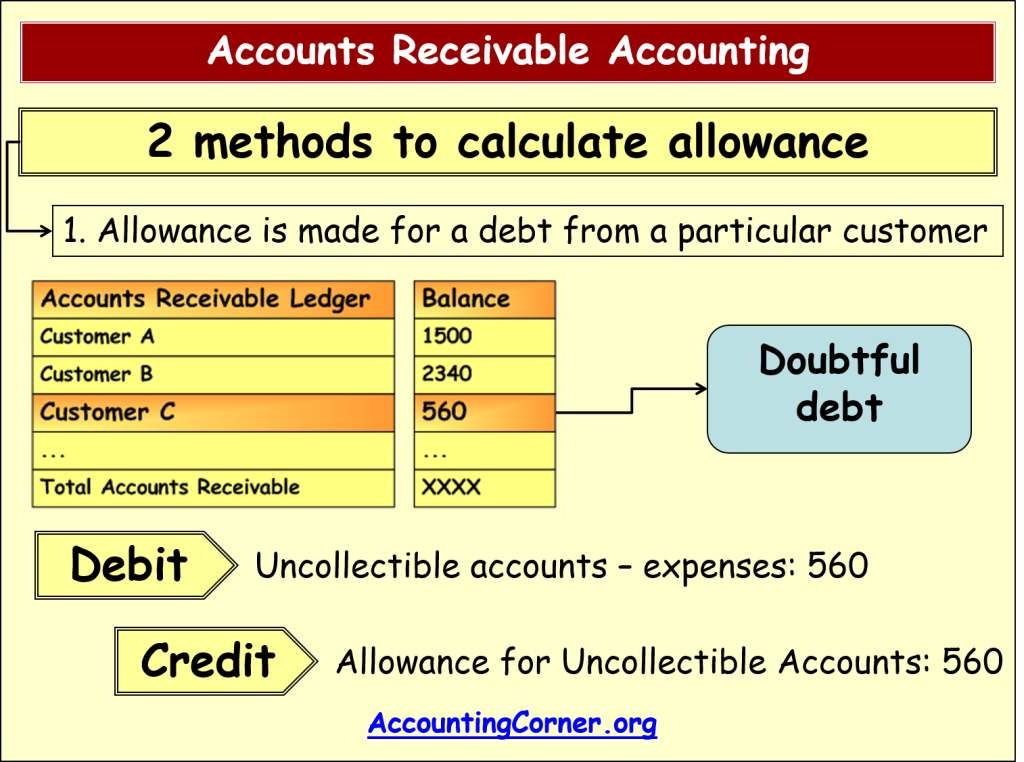

Allowance for Doubtful Accounts Definition + Examples

Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web on december 31 the allowance account showed a credit balance of $3,000. Web.

Allowance for Doubtful Accounts Methods of Accounting for

Debit bad debt expense for $13,000, credit allowance. A) increases the cash realizable value of accounts receivable. Web allowance for doubtful accounts on the balance sheet: B) appears under the heading other assets. c) is offset against total current assets. If the desired ending balance is $13,000, what adjusting entry should be made?

Allowance for Doubtful Accounts Overview and Examples Hourly, Inc.

Web on december 31 the allowance account showed a credit balance of $3,000. A) increases the cash realizable value of accounts receivable. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount.

What is an example of an allowance? Leia aqui What are five allowances

Web on december 31 the allowance account showed a credit balance of $3,000. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web the allowance for doubful accounts is debited and accounts receivable is credited. If the desired ending balance is $13,000, what adjusting entry should be made? B) appears under the heading.

PPT Chapter 7 Accounts Receivable and Notes Receivable PowerPoint

A) increases the cash realizable value of accounts receivable. All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubful accounts is debited and accounts receivable is credited. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of.

How to Calculate and Use the Allowance for Doubtful Accounts

Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web the allowance for doubful accounts is debited and accounts receivable is credited. Debit.

Solved 1. Estimate the balance of the Allowance for Doubtful

Web on december 31 the allowance account showed a credit balance of $3,000. All receivables that are expected to be realized in cash within a year are reported. B) appears under the heading other assets. c) is offset against total current assets. Debit bad debt expense for $13,000, credit allowance. Web the allowance for doubful accounts is debited and accounts.

Allowance for Doubtful Accounts Accounting Corner

Web the allowance for doubful accounts is debited and accounts receivable is credited. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. If the desired ending balance is $13,000, what adjusting entry should be made? All receivables that are expected to be realized in cash within a year are reported. Web the estimation.

Allowance for Doubtful Accounts Personal Accounting

If the desired ending balance is $13,000, what adjusting entry should be made? Web the allowance for doubful accounts is debited and accounts receivable is credited. Web on december 31 the allowance account showed a credit balance of $3,000. A) increases the cash realizable value of accounts receivable. B) appears under the heading other assets. c) is offset against total.

Cash Accounts receivable Less Allowance for doubtful

Debit bad debt expense for $13,000, credit allowance. B) appears under the heading other assets. c) is offset against total current assets. If the desired ending balance is $13,000, what adjusting entry should be made? All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubtful accounts is reported as a.

Web Allowance For Doubtful Accounts On The Balance Sheet:

Debit bad debt expense for $13,000, credit allowance. All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubful accounts is debited and accounts receivable is credited. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet.

If The Desired Ending Balance Is $13,000, What Adjusting Entry Should Be Made?

A) increases the cash realizable value of accounts receivable. B) appears under the heading other assets. c) is offset against total current assets. Web on december 31 the allowance account showed a credit balance of $3,000. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)